SAMPLE POSTS, [SCHW] Charles Schwab

some thoughts on Charles Schwab

I have a post on APi Group and Amphenol coming toward the end of the month but before then I wanted to offer some thoughts on Charles Schwab. Nothing here is investment advice.

Last week I was joking with my friends LibertyRPF and MBI that Twitter felt like a time machine taking me back to 2008-2009, when as a young associate at Fidelity I was tasked with scrutinizing in gruesome detail the balance sheets of insurers and words like “held-to-maturity (HTM)” and “available-for-sale (AFS)” became fixtures in my daily vocabulary. I never expected HTM and AFS to come back into vogue, but here we are. Everyone reading this likely knows by now what these terms mean, but just in case here’s the definition from the SEC:

HTM securities, which management has the intent and ability to hold until maturity, are carried at amortized cost. AFS securities are carried at fair value and unrealized gains and losses are reported as net increases or decreases to accumulated other comprehensive income (“AOCI”).

So what Schwab does is it deposits the cash balances from client accounts into its bank and mostly invests those deposits in US government-backed securities which, while rock-solid from a credit perspective, are still underwater thanks to rising rates. “AOCI”, which you can find in the shareholders’ equity part of Schwab’s balance sheet, primarily reflects after-tax unrealized losses on Schwab’s AFS securities, plus the after-tax unrealized losses on AFS securities that Schwab transferred to the HTM bucket last year to avoid having to include further unrealized losses in AOCI (this will become relevant later).

The “gotcha” hot take goes something like this: did you know that AOCI doesn’t include unrealized losses on HTM securities at year-end and that taking those losses into account would wipe out nearly all of Schwab’s tangible equity? Did you know??….the implication being that Schwab’s bank is technically close to insolvency.

But of course there is a difference, often a huge one, between tangible GAAP equity and regulatorily capital. In banking, there are several capital ratios that need to be maintained above a certain threshold. For Schwab, the most restrictive one is the Tier 1 Leverage Ratio, which divides Tier 1 Capital into assets and certain off-balance sheet exposures. For all but the largest banks1, you can basically think of Tier 1 capital as tangible common equity plus preferred equity minus unrealized gains and losses. What this means is that the unrealized losses on Schwab’s securities don’t impair T1 capital until those losses are realized, either through credit impairment or sale. Because the vast majority of Schwab’s investment portfolio is parked in super safe government-backed securities, its Risk Weighted Assets (the sumproduct of interest-earning assets multiplied by a risk weight proportional to each asset’s credit risk) are very low and its Common Equity Tier 1 Ratio (CET1 – tangible common equity minus unrealized gains/loss divided by risk weighted assets) is a whopping 22%, way above the 7% minimum. So Tier 1 Leverage the far more restrictive ratio and unlike the CET1 ratio, which only counts common equity as capital, any capital holes can be plugged with preferred stock from Uncle Warren.

Since 85% of Schwab’s securities are backed by the US government, we don’t really have to worry about credit quality. But we do need worry about Schwab being forced to liquidate those securities (thus converting unrealized losses to realized losses that hit T1) to meet deposit withdrawals from clients who want to take advantage of higher rates, a dynamic known as “cash sorting”.

At year-end, Schwab reported $40bn of Tier 1 Capital against $567bn of assets, for a Tier 1 Leverage Ratio of 7.2%. The minimum capital requirement is 5% so we’re starting with a $12bn capital buffer that organically expands as the balance sheet shrinks (more on this later).

So a critical question here is: will there be so much cash sorting that Schwab is forced to sell investment securities at a loss, thus dragging the Tier 1 Leverage Ratio below the 7% threshold and forcing a capital raise that potentially death spirals into abysmal dilution. The 22% decline in Schwab’s stock over the last 2 days suggests the market is assigning a non-trivial probability to this scenario.

Here are what I believe to be the sources of funding at the end of 2022, with numbers pulled from Schwab’s 10-K:

Cash: $40bn (excludes $43bn of “Cash and investments segregated and on deposit for regulatory purposes”)

Available FHLB secured credit facilities: $69bn (the Federal Home Loan Banks, FHLB, provides loan advances against a range of collateral to help member banks meet short and long-term liquidity needs. The haircut on government-backed collateral is small, 1%-2%, reflecting their liquidity and minimal credit risk. Subsequent to Dec. 31, 2022, Schwab drew down an additional $13bn of FHLB advances. Since we don’t know the intra-quarter sources and uses of funds, let’s ignore this for now. Doing so doesn’t materially impact the analysis)

US Agency and Treasury AFS securities that mature in < 1 year: $22bn (these could be sold without realizing material losses)

Federal Reserve discount window: $8bn

Unsecured commercial paper: $5bn

Uncommitted, unsecured lines of credit: $2bn

AFS securities at fair value minus the short-duration US Agency and Treasury securities listed above: $123bn

(in addition to all this, Schwab has another $173bn of HTM securities, which I treat as untouchable given the impact that realizing losses here would have on statutory capital)

There are a few important caveats.

First, in order to access FHLB funding, banks need to maintain positive tangible capital, the definition of which is set by the Federal Housing Finance Agency who, for reasons that defy logic, includes unrealized losses and gains on AFS securities. So you can see now why Schwab moved $173bn of AFS securities to HTM last year. Had they not done so, any further unrealized losses on those transferred securities would have hit their GAAP tangible equity and possibly compromised their ability to access FHLB funding.

However, even under this more onerous definition of tangible capital, I still think Schwab’s access to FHLB advances is secure. They reported GAAP tangible equity of $16bn at year-end and are generating ~$8bn of run-rate after-tax earnings. Their AFS securities were fair valued at $148bn, which includes $12bn of unrealized losses, $25bn of which rolls off in less than a year. So for Schwab to blow through its $16bn of tangible equity (even setting aside the considerable earnings build and the <1 year maturities) unrealized losses on AFS securities, 85% of which are backed by the US government-backed, would have to more than double from year-end levels. Eye-balling the maturity buckets of Schwab’s AFS securities, this might require a nearly 150-200 bps upward shift across the Treasury curve.

Second, the $69bn of available FHLB advances would be collateralized by a roughly equal portion of Schwab’s $307bn of securities ($148bn AFS + $159bn HTM), but I don’t know much of that collateral would be coming from AFS vs. HTM, so including the entire pool of AFS securities as a source of funds, in addition to $69bn FHLB advance, is double counting to some extent. $69bn of borrowing availability is about 22% of Schwab’s AFS and HTM securities. Multiplying that percentage by $148bn of AFS translates to about $33bn of AFS securities that are pledged as collateral to the FHLB and unavailable for liquidation, leaving us with $90bn of unrestricted AFS.

Third, is there actually $69bn of FHLB funding available? At least one Twitter person thinks no, arguing that “FHLB system isn’t built for these behemoths that are…larger than the FHLB”. While this anon provides no additional context, I don’t think this risk should be outright dismissed. Silicon Valley Bank was unable to tap its full FHLB borrowing capacity for reasons I don’t fully understand. Given the relentless outflows at SVB, maybe the FHLB concluded that lending to them was a lost cause.

To be on the safe side let’s assume that, contrary to Schwab’s disclosures, none of the remaining $69bn of FHLB advances are available and that this year the company is met with a gargantuan $100bn of outflows, nearly 30% of their year-end deposit base. After eating through $40bn of cash and $22bn of short-dated govies, Schwab would need to sell ~$40bn of AFS securities with 1+ year maturities to meet remaining redemptions. The unrealized losses on the full $123bn of >1-year AFS securities was about $12bn at year-end, but let’s say those mark-to-market losses have since widened to like $15bn, or ~$11bn after-tax. In this scenario, Schwab would realize about ~$4bn of a/t losses on its $40bn AFS liquidation. With $100bn of deposits and assets now off the balance sheet, Schwab’s Tier 1 Leverage ratio improves from 7.2% to 8.6%, leaving about $17bn of capital cushion, enough to absorb the ~$4bn of realized losses from the AFS sales, even without taking into account the, say, ~$6bn-ish of pro-forma earnings that would flow into retained earnings throughout the year.

But what amount of outflows can we reasonably expect? Schwab has $17bn of outstanding loan balances that come due after June and, more importantly, X% of $367bn of bank deposits that will cash sort out of the bank and into higher yielding alternatives, either out of fear or greed. What is X?

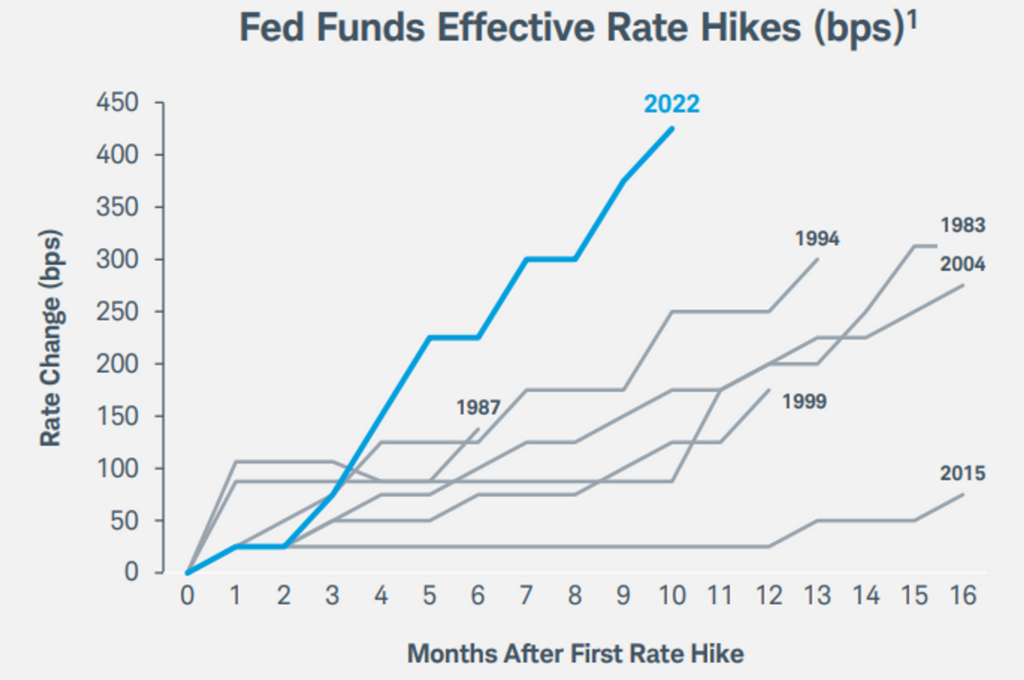

Well, since cash sorting responds to changes in the Fed Funds rate, it should not come as too big a surprise that Schwab’s bank deposits declined by $77bn ($444bn → $367bn) from 2021 to 2022, as the Fed took rates from 0 to 4%+, the fastest pace of hikes in 40 years.

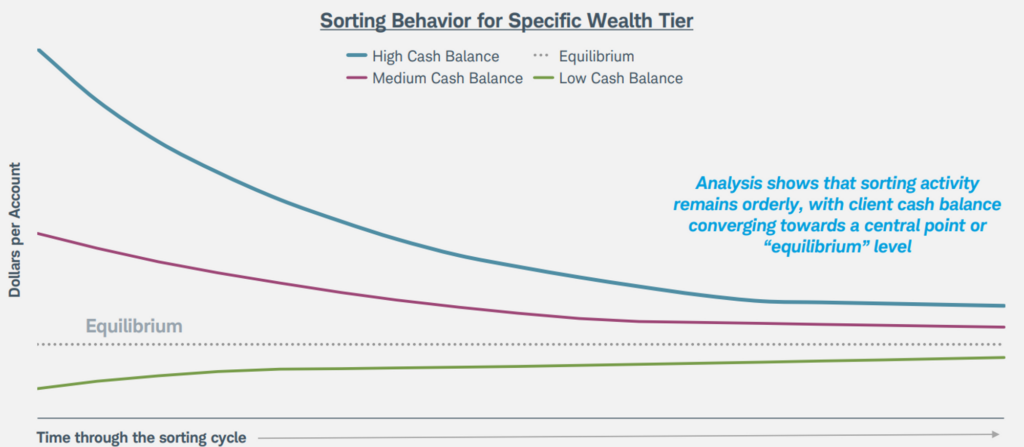

What Schwab has observed throughout its history, though, is that cash sorting settles down as rate hikes cease. Clients want to maintain some minimum amount of transactional cash in their accounts. Whether starting with high levels of cash or low levels of cash, they all converge toward an “equilibrium” level.

According to Schwab, the above analysis was done “across 30 different wealth tiers, across 5 different client segments and the pattern is exactly the same”. On their Jan. 27 earnings call, management claimed they were in the “later innings” of the cash sorting cycle and that the cash they were getting from new accounts was offsetting “any lingering sorting activity” from existing accounts. All this is just to say that if Fed Funds goes from ~4.5% to, let’s say ~5%-5.5% this year, it would be quite surprising to see the same ~$77bn of cash sorting deposit outflows that Schwab experienced in 2022, when rates exploded from 0% to over 4%….and needless to say, the Fed is almost certainly re-evaluating its hawkish posture in light of SVB’s failure and the ensuing anxiety.

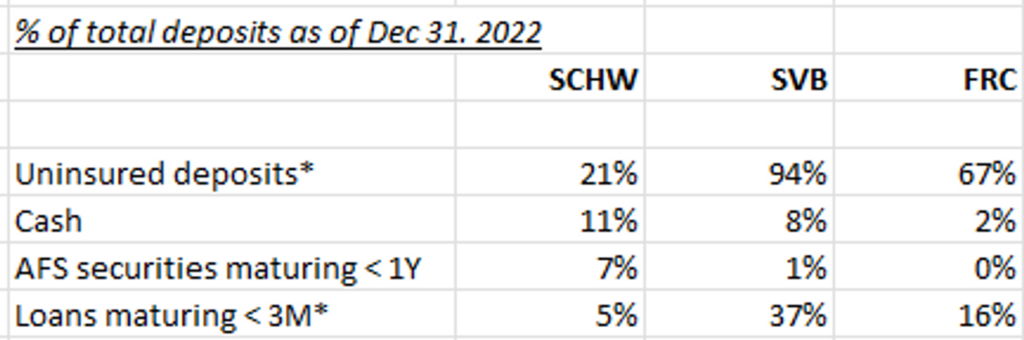

So if this were just about run-of-the-mill cash sorting, I think Schwab could cover deposit outflows under any reasonable bear case scenario. But with Silicon Valley Bank now defunct, things have changed. From a liquidity standpoint, I think Schwab is in a much stronger position than SVB or even First Republic for that matter. Whereas uninsured deposits – that is, deposits exceeding the FDIC insurance threshold and therefore most likely to flee in a panic – comprised an estimated 94%(!) and 67% of SVB and FRC’s total deposits, respectively, at year end, they made up just 21% of Schwab’s. Plus, cash and readily salable AFS securities cover the near entirely of Schwab’s uninsured deposits. The same cannot be said of SVB and FRC.

But anxiety is contagious. You can imagine: someone reads about the SVB collapse, sees that Schwab’s stock is down a lot, assumes something must be seriously wrong there too, and pulls their cash from Schwab bank into T-Bills, forcing more liquidity pressures that push the stock lower, etc. in a reflexive doom loop. In 2022, cash sorting was provoked by rate hikes so rapid that even as bank deposits declined by 17%, net interest income still grew 33%. This year though, if cash sorting is motivated by fear rather than greed, a similar level of outflows would not be accompanied by higher rates. Moreover, FHLB advances are expensive. At year-end, Schwab was paying 4.9% on outstanding balances. If $50bn of ~0% deposits are replaced with 5% FHLB advances (assuming that’s even possible), we’re talking about an incremental ~$2bn hit to after-tax earnings per year on a current run-rate base of $8bn. In short, even if a mass outflow of deposits doesn’t impair capital it may drive earnings lower until people calm down, at which point fear-driven cash sorting is reversed and fresh deposits can be put to work at today’s higher rates. If liquidity concerns prove to be a hiccup and things go back to pre-SVB days in short order, I think there’s a credible path to $6-$7 of per share owners’ earnings (that is, earnings after the incremental capital has been posted to support asset growth) in 5 years. At 20x + accumulated dividends, you’re looking at ~18%-20% returns off the current price ($59).

I admit to being wary about publishing this post, as the reputational damage of being wrong on something like this far exceeds the benefit of being right. If Charles Schwab’s bank teeters into receivership, it will be one of the biggest financial events in years and anyone who suggested that failure was unlikely will be dog-piled with told-ya-so’s. If it turns out that Schwab is fine and the stock recovers to ~$75+, people will shrug and move on with their day.

Let me be clear. While I think it would take a colossal outflow of deposits – something well north of $100bn – to take Schwab down, it would be foolish to deem this scenario impossible given the stench of panic pervading the air. It’s human nature to extrapolate what’s happening today further into the future than is warranted and sometimes this tendency can be profitably faded. But this approach can fail horribly when public confidence itself is an input to intrinsic value, as it is with banks.

A public service announcement is warranted here. My memories of the GFC are all too vivid. I remember bank CDS, quoted in single digit basis points just a year ago, being traded for points up front. I remember puzzling over how to dimension liquidity needs, how big a capital crater subprime CDO exposures might leave, and how much, if any, government support would be available. I remember reasonable-sounding write-ups (like this one!) invalidated within days. I remember an otherwise stolid co-worker pushed to tears by the emotional strain of an especially harrowing week. I wish this on no one. If you think this could be you, maybe just $CSU and chill (not investment advice!).

On Twitter, comparisons between the GFC and what’s happening today have been rightly poo-poohed. Back then, major banks were holding toxic assets on razor thin capital bases. Valid solvency concerns fed into liquidity strains. The term “other-than-temporary-impairments (OTTI)”, where impairment charges are taken on securities whose fair value is not expected to recover to par, was on the tip of everyone’s tongue in 2008. Nobody is using it today because credit quality is not a core issue. But what both periods have in common is fear, and fear doesn’t dispassionately ask whether your securities are par paper, nor does it wait for earnings to leisurely bleed into capital. It punches you in face as it darts for the exit.

(special thanks to @willis_cap, who went back and forth with me on Schwab throughout the weekend while he was on vacation in Hawaii and offered helpful suggestions to this write-up)

Disclosure: At the time this report was posted, accounts managed by Compound Insight LLC owned shares of SCHW. This may have changed at any time since.

- Category I and II banks, those with greater than $700bn of total assets or those designated “global systemically important”, are required to include AOCI in CET1 (see here).

Pingback: click here

Pingback: Hunter898

Pingback: พรมปูพื้นรถยนต์ 6d

Pingback: Sig sauer guns

Pingback: สล็อตออนไลน์ 2LOTVIP เว็บตรงไม่ผ่านเอเย่นต์ รวมเกมแตกง่าย

Pingback: betmw168

Pingback: condo for sale pattaya

Pingback: slot88

Pingback: เว็บพนันบอลออนไลน์ ฝากถอน ไม่มี ขั้น ต่ำ