Class 1 rails, SAMPLE POSTS

Class 1 freight rails: part 3 – Hunter Harrison, PSR, and investment implications

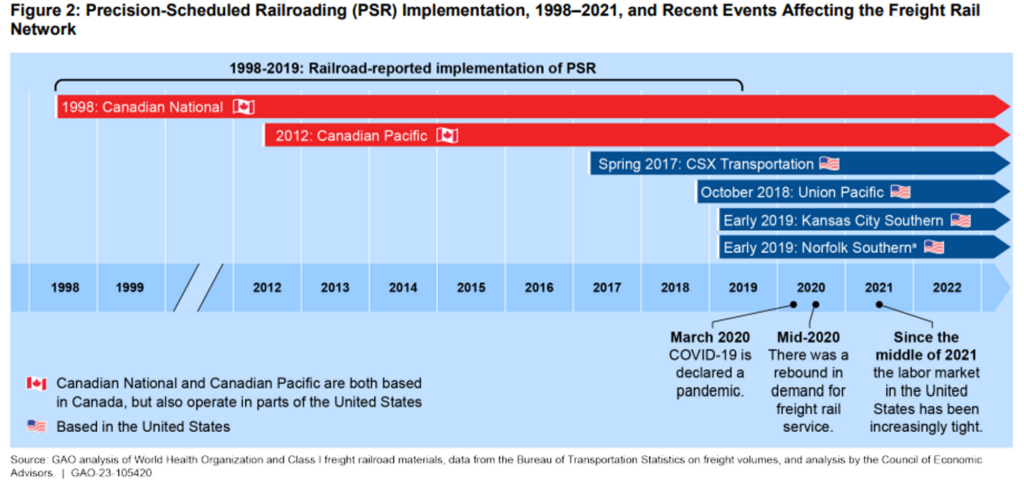

No analysis of the North American railroad industry would be complete without a discussion of Hunter Harrison as no single person has had a bigger impact on the operating performance of Class 1 railroads over the last 25 years. A lifelong railroader who began his career oiling railcars in the early ‘60s when he was just 19 years old, Hunter had turned around 3 railroads (Illinois Central, Canadian National, Canadian Pacific) and was on his way to reviving a fourth (CSX) by the time he passed away in 2017. The principles enabling the dramatic productivity gains at the companies he steered are codified as Precision Scheduled Railroading.

Before PSR took hold across the industry, trains would not depart until fully loaded. They would wait for every shipper’s car to be hitched, such that an outbound train to Kansas City could be idling in Oklahoma City for 14 hours until the arrival of an inbound train from Houston, which in turn would hold up the train from Kansas City to Chicago, etc. Waiting optimized for longer trains but also had the nasty side effect of congesting yards and impeding on-time delivery, much like globules of cholesterol clog the arteries of a circulatory system, preventing blood cells from delivering oxygen to organs. What Hunter Harrison envisioned was a fluid system, one where the right payloads would get to the right place at a scheduled time.

In a network, where nodes are reliant on other nodes for traffic, a constriction here can create delays over there, which can cascade into hold ups over there, etc. Anyone who has flown commercial intuitively understands this. Like airport terminals jammed with stranded passengers, yards of mounting railcar inventory are symptomatic of a sick network. It follows then that a healthy network is one where cars are in constant motion, as approximated by dwell time (the amount of time a railcar spends waiting at a terminal) and, relatedly, car speed (distance divided by time, with time going down as cars spend less time idling at terminals). A train with 200 cars is preferable to one with 80 – same fixed cost of fuel and crew spread across more payload – but those cost savings are for naught if the time spent building longer trains causes delays that create inefficiencies elsewhere. That’s not to say train length doesn’t matter. Just that it is optimized within hard scheduling constraints – fewer pickups with strict take-it-or-leave-it departure times – rather than according to the whims of a customer.

PSR dictates that a railroad optimize car movement across the entire network rather than hit local maxima. In the same way that UPS concerns itself with the on-time door-to-door delivery of packages than with the movement of its trucks, so too do PSR proponents emphasize the predictable delivery of carloads from origin to destination rather than the speed and on-time performance of its trains. It doesn’t matter if a train gets from one yard to the next in record time if the railcars it unloads just sit there awaiting pickup for days.

I certainly don’t understand the intricacies of PSR well enough to get into the fine-grained details of how this is done (and in any case, describing the nuances of a rail network in an essay is kind of like inferring the shape of a complex 3D object from its 2D shadow) but at a high level, scheduled railroading demands simplification, which in practice means: removing hump yards (hundreds of acres of track-laced land where incoming railcars are sorted according to shared outbound destinations), including the associated infrastructure and supervision required to manage its multiple processing steps, and switching trains at smaller flat yards instead; discarding underutilized lines and shuttling longer trains on more direct routes; commingling different freight types to drive incremental volume without additional train starts; and yes, pissing off customers forced to adapt their logistics to the rail rather than the other way around.

Managing network health holistically has all sorts of benefits. Point-to-point hauls lead shorter transit times and more reliable delivery, in the same way flying direct does. Keeping more trains in motion longer means fewer locomotives and railcars for a given volume of freight, which means fewer crew members to drive those trains, fewer mechanics to maintain them, and fewer yards to hold and switch them (with the freed up land either sold or repurposed into warehousing and transloading facilities that bind a railroad closer to their customer). It means the railroad can raise wages for the remaining workforce and still realize margin gains as trains haul freight over longer distances for every hour a unionized employee is paid. It means they can reserve less inventory, parts, and shop space to repair trains and mix toward a newer, lower maintenance fleet as the trains removed from action are the oldest, least fuel efficient ones most in need of care. It means they can stand behind superior service that shippers will pay up for.

These changes don’t comes naturally for a railroad constructed piecemeal through the acquisition of hundreds of smaller lines with parochial interests. Before Hunter Harrison took over, CSX had like 10 divisions that were run as independent companies, each with its own dispatch center and hump yards. Scheduled departures and holistic network-wide considerations were arguably as radical a break from industry tradition as Ryanair enforcing single class seating, operating a single model of aircraft, and targeting less congested airports to hasten take-off times.

Culturally, PSR espouses the philosophy of continuous improvement, a mindset that encourages managers to ask “why” and challenges conventional practices (if a hump yard is the final destination for 10% of cars, why not shut it down and find more efficient routes for the other 90%?), much like the Danaher Business System. The image of Danaher executives on factory floors redesigning machine layouts mirrors that of Hunter Harrison at trainyards listening to radio comms between supervisors and yardmasters or checking into a hotel with a set of binoculars just to evaluate yard operations1. Whether HH studied DBS/kaizen explicitly, he certainly embodied its spirit in his disdain for bureaucracy and the trust he placed with local decisionmakers who were closest to the action and made accountable for results.

Even if Hunter Harrison was the first to clearly see the consequences of PSR, by the early 2000s its basic principles were widely understood, having first been successfully executed at Illinois Central during the early ‘90s. Really what was missing was the will to pull it off. The industry had ossified into cozy regional duopolies run by old timers, insulated within layers of bureaucracy, who prioritized politeness over performance and stasis over speed, who had for so long been steeped in a culture of mediocrity that they had never considered what was possible. And fair enough! Even a go-getter with fresh eyes might observe that rail systems operated as part of a complex ecosystem that had evolved over the course of centuries and assume a Chesterton Fence explanation for why the industry worked the way it did.

Pulling off the radical changes required for step-function improvements required not only “thinking from first principles” but a tone deaf disregard for the way things had always been done. Because the idea of constantly looking for ways to take assets out of the system by operating more efficiently was a direct threat to legions of rail managers accustomed to thinking that problems were solved by throwing resources at them, that their career value corresponded to the scale of assets under their purview, that the customer always came first. Hunter flatly disagreed:

At a conference years later, Harrison recalled Burlington Northern had put stickers up all over its operation that said “The customer is always right.” Harrison joked to a roomful of railroaders that he went around ripping the stickers off the wall. He’d come to the conclusion that if you said yes to everything the customer wanted, you wouldn’t make any money (excerpt from Railroader)

Before PSR proved its value at one major railroad after the next, it had to be imposed by iron will. That even the most basic and obvious improvements – like requiring people to work the full 8 hours they were paid instead of finishing a task in 4 hours and bouncing for the day or having two trains traveling in opposite directions swap crews halfway through their destinations to avoid the lodging and meal costs of overnight stays – were somehow overlooked testifies to just how complacent these organizations had become. Only a renegade insider who eschewed internal politics and dishonored tradition could scythe through layers of bloat and mismanagement.

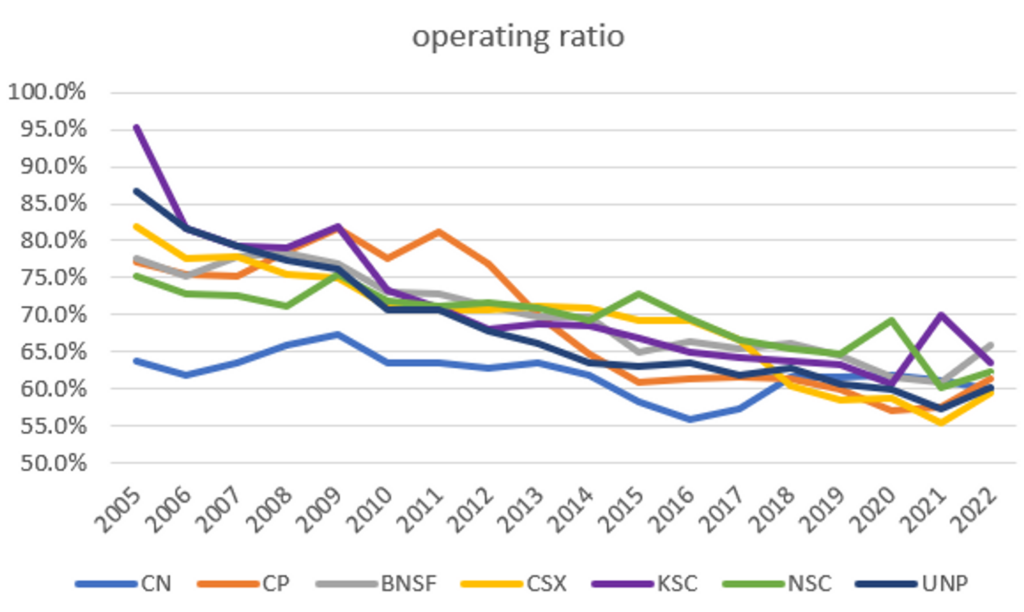

For every time Hunter parachuted into an ailing railroad, he faced resistance from those who could not fathom the idea that they had been doing it wrong this whole time. Skeptics objected that the turnaround at Illinois Central, a regional Class 1 whose Operating Ratio (expenses divided into revenue) collapsed from the high-90s down to 62% under Hunter’s tenure, couldn’t be replicated on a larger scale in harsher climates…until Hunter took the reigns at the transcontinental Canadian National, who had 5x the revenue, and dragged the OR from 79% to 62% over 10 years. At Canadian Pacific, where the OR plummeted from ~80% to 60%, the mountainous Western terrain did not dilute the impact PSR as doubters predicted. Nor did the “spaghetti bowl” network of short lines at CSX, whose OR has improved from ~70% to 60%.

Despite a harsh temperament and a rambunctious, hard-nosed style that clashed with the demure, buttoned down sensibilities of the Canadian railroads he commandeered, Hunter was also known to be an inspirational mentor who had a sharp eye for talent and took considerable time to foster it. At luxurious retreats, Hunter Camps, he schooled promising managers on the merits of PSR and is today survived by loyal disciples who have carried on his work at other companies, including James Foote and Jamie Boychuk at CSX, Jim Vena at Union Pacific, John Orr at Kansas City Southern, and Keith Creel at Canadian Pacific.

Source: GAO Report to Congressional Requesters (Dec. 2022)

But PSR has not been without critics. With labor reductions making up the largest component of OR gains by far, some believe that PSR ultimately boils down to draconian cost cuts that eventually come back to bite its practitioners in the ass. CSX suffered major issues as they began executing the PSR playbook in 2017. NSC, 3 years into PSR, is now facing fierce criticism over the disastrous derailment of a 149-car chemical train that led to the evacuation of a small town this past February. And just look at the degradation in service and operating margins caused by the whipsaw of post-COVID demand patterns and the consequent scramble to replenish crews that had been so enthusiastically cut in years past. Moreover, while PSR may have rewarded shareholders, skeptics will argue that those gains have come at the expense of certain unionized employees, who claim they are subject to more dangerous working conditions, and shippers, who at great cost and inconvenience have had to reconfigure their own logistics to strict time tables or have had their service interrupted as railroads concentrate on the most profitable corridors, in possible violation of common carrier obligations that require them to transport all approved freight at reasonable terms.

First, I think the immediate disruption arising from radical change can be a poor gauge of whether that change ultimately makes sense. If commercial airlines operated the same way freight rails did 20 years ago, maximizing for load factor by holding planes on the tarmac until all ticketed passengers arrived, I’m sure that suddenly switching to strict departure times would have provoked fierce resistance from passengers who liked the way things were before. But if we had to write commercial aviation rules from scratch, who would argue against non-negotiable departure times? Likewise, PSR is bound to provoke complaints, especially early in its implementation, as it forces shippers to alter their operations and nobody enjoys having change forced upon them. Some may even be made permanently worse off than before. But beyond the initial stages of disruption, a fluid network with more reliable delivery times is probably better for the modal shipper and the logistics ecosystem as a whole.

Second, railroads aren’t set up to handle outsized fluctuations in volume. While it is tempting to point to PSR as the primary culprit behind the service disruptions last year, consider that BNSF, who has long resisted PSR, and NSC, who didn’t start scheduled railroading until 2019, were among the 4 Class 1s harangued by the Surface Transportation Board for deficient service. In an alternative history where PSR wasn’t adopted at all, would the industry have managed post-COVID disruptions better? I’m skeptical. From what I gather, service issues emerged because railroads, like many other industrial companies, mis-calibrated the shape of demand: they were too quick to lay off employees in response to the sudden collapse in volumes early into the pandemic, leaving them ill-equipped to manage the unexpected surge in demand that shortly followed in a very tight labor market.

Third, describing PSR as little more than a brute cost cutting program gets it backward. For the most part, cost reductions aren’t the cause of efficient operations, they are the consequence. A network that has been reconfigured to facilitate car movement, leading to less yard inventory and fewer jams, should require fewer trains, fewer yards, and less labor than before. Also, while PSR adopters are sometimes accused of skimping on capital investment, the reality is murkier. While it’s true that reductions of locomotives and railcars follow from PSR-driven efficiency gains, the vast majority of a railroad’s capex is concentrated in track infrastructure. CP spent more on capex as a % of revenue in the 8 years after PSR, and over the last decade CP and CN have each spent proportionally more than PSR holdout Burlington Northern (20% vs. 17%).

On the other hand, CSX has cut back on capex dramatically, from ~20% to low-teens of revenue, since starting PSR. But I would caution against drawing hard conclusions from that because looking back far enough in history, you will often find multi-year stretches of low capex followed by big spikes. For instance, while CSX was running capex at 20% of revenue in the 6 years prior to starting PSR in 2017, in the 6 years from 2004 to 2009 they were at only 15%, right where they are today.

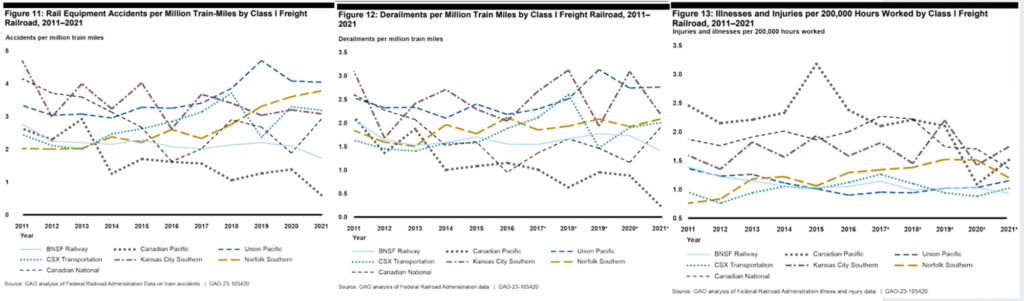

Finally, I don’t see much evidence to back the claim that resource take-outs accompanying PSR have degraded safety:

Source: GAO Report to Congressional Requesters (Dec. 2022)

The clear outlier here is Canadian Pacific, whose accident, derailment, and injury stats have improved considerably in the decade since PSR was adopted. And CN’s injury frequency rate dropped precipitously after PSR, from 7.3 per 200k person-hours in 1999 to just 1.8 by the time Harrison retired2.

In a report from last December, the US General Accountability Office concludes:

Federal Railroad Administration (FRA) officials stated that data from 2011 through 2021 are inconclusive about the extent to which operational changes associated with PSR may have affected rail safety, but have taken steps to address potential risks. Class I railroad representatives generally stated that these operational changes improved or had no effect on railroad safety. In contrast, rail safety inspectors and employee unions identified safety concerns related to reductions in staff and longer trains.

In general, I find the idea that efficiency comes at the expense of safety to be a little odd in that accidents cause downtimes and are terrible for smooth operations. Can you think of an industrial company that has simultaneously sustained above average returns with below average safety? When executives declare “safety is our number 1 priority” they do so not just because it is one of those nice things you’re supposed to say to signal responsible corporate citizenship to regulators (you wouldn’t want to stand out as the only railroad not leading earnings calls with a shout out to safety) but also because safe working conditions really are a necessary precondition for operating efficiently. No altruism required. A selfish drive to maximize profits will also motivate you to minimize injuries.

I guess where I land is that 2022 was just an exceptionally disruptive year that would have confounded any railroad, PSR or not. It’s likely that some PSR programs were too aggressively implemented. But this seems more like an overshooting issue to be tweaked through tactical adjustments than an indictment of PSR as an operating model. In fact, CSX and NSC appear to have fully recovered and Union Pacific is on its way.

But if PSR has ambiguously impacted service and safety, it has been the indisputable driver of the industry’s efficiency gains over the past decade or so.

Or has it?

This seems like a silly question at first blush. After years of stagnant and below average margins, is it reasonable to think that CN, CP, and CSX would have suddenly whipped themselves into financial shape without Hunter Harrison’s guidance? Probably not.

On the other hand, most Class 1 rails were already seeing major OR reductions before they adopted PSR. This includes BNSF, who explicitly eschewed the philosophy:

So maybe the margin improvements attributed to PSR would have come even if the world had never heard of Hunter Harrison.

But I have a hard time believing that. In 2005, with the exception of CN, who was then 7 years into PSR and boasted the highest margins in the industry by far, Class 1 operating ratios were no better than they were in the early/mid-’90s. Then out of nowhere the US players, none of whom had yet explicitly embraced PSR, cut their OR by 16 points over the next decade. For me, the most resonant explanation is that Hunter’s influence seeped through every major railroad, either directly through the changes he imposed or indirectly in the pressure he created for everyone else to match the productivity gains wrought by PSR. With CN and then CP, Harrison, with the backing of prominent activist Bill Ackman, proved what was possible, both to peers but also to investors, like Roger Bannister breaking the 4-minute mile. No self-respecting Class 1 management team would have been permitted to continue reporting ORs in the high-70s/80s with CN reporting low-60s and CP trending that way immediately after HH took charge in 2012. The industry had a fire lit under its ass. Hunter was holding the match.

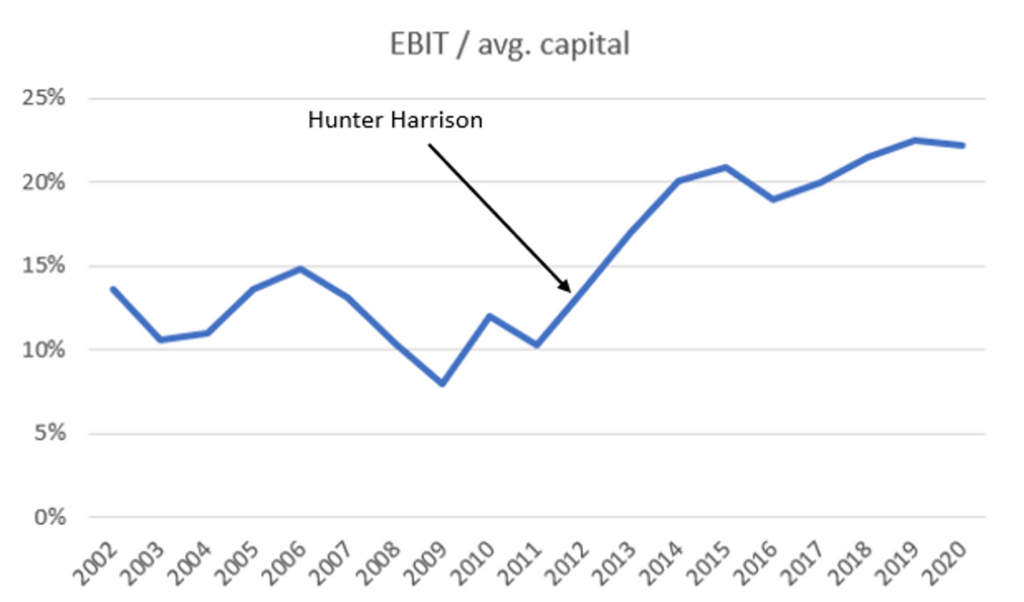

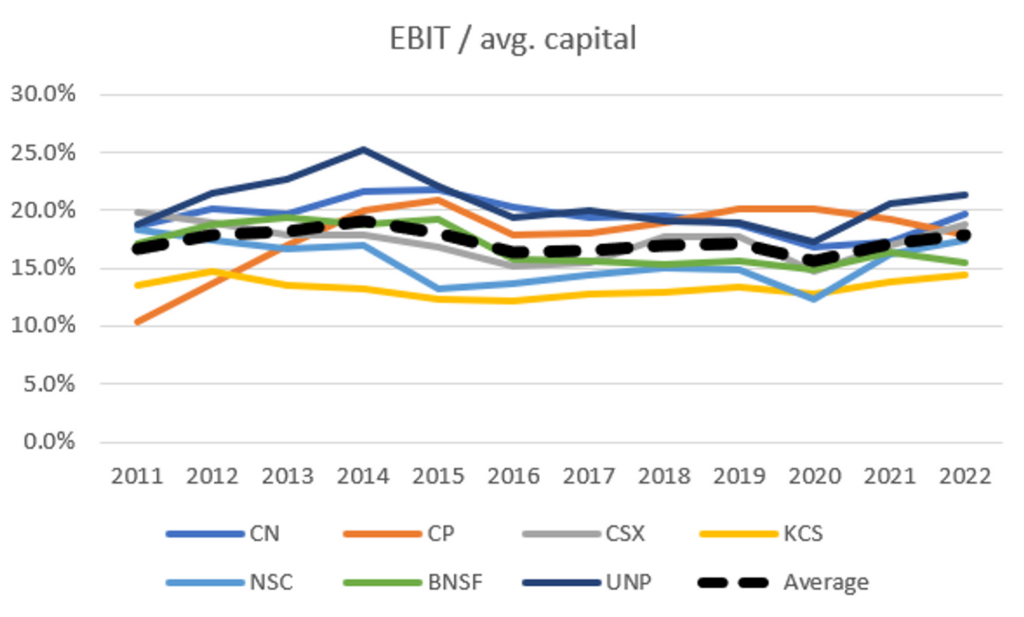

A reasonable pushback is that while PSR may have fueled margin expansion, its impact on ROIC has been more ambiguous. For CP, Hunter Harrison’s influence is clear cut and obvious.

Less so at CSX. While pre-tax returns improved from ~15% in 2016, the year just before HH came onboard, to 18% 3 years later, in 2016 the industry was still in the midst of a mini-industrial recession that it clawed out of by 2019. There is no difference in CSX’s 5-year average ROIC before-and-after PSR.

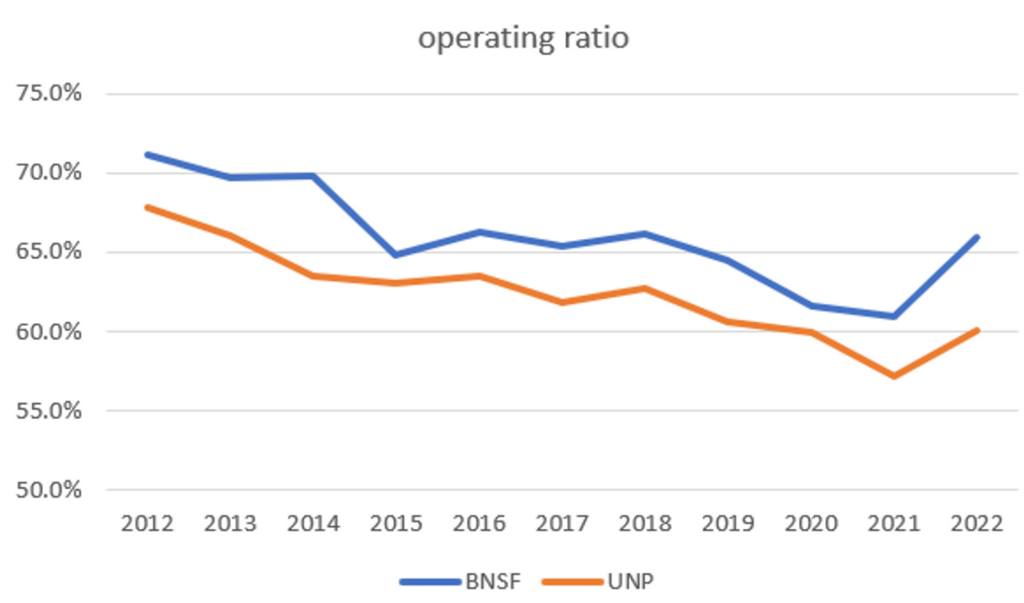

But we have to consider the counterfactual. What would returns have been under the status quo? Whether or not PSR was adopted, capital requirements would have outpaced revenue growth. Operating efficiency was the key lever railroads had to counteract this effect. Compared to UP, PSR-holdout BNSF has reported higher ORs (lower operating margins) every single year over the last decade.

Meanwhile, both companies generate about the same amount of revenue per dollar of capital, a figure that has declined by a similar amount over that period. The net result is that BNSF’s pre-tax returns on capital have deteriorated a bit over the last decade, from 19% to 16%, while UNP’s has at least remained stable at ~20%.

It’s interesting to observe that while the industry is converting revenue into far more EBIT than they did 10 years ago, every dollar of EBIT still requires about the same amount of capital to generate as before, another reminder that these are very capital intensive businesses and even significant margin gains can be a misleading indicator of the degree of value creation. But like it or not, operating ratio improvements, and the GAAP earnings growth that come along with it, move rail stocks.

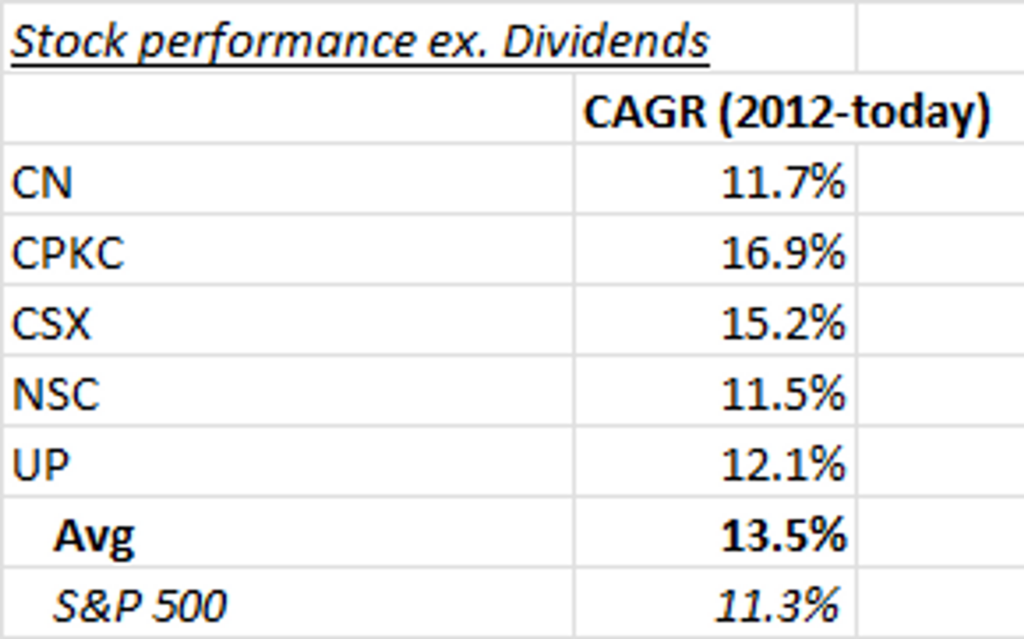

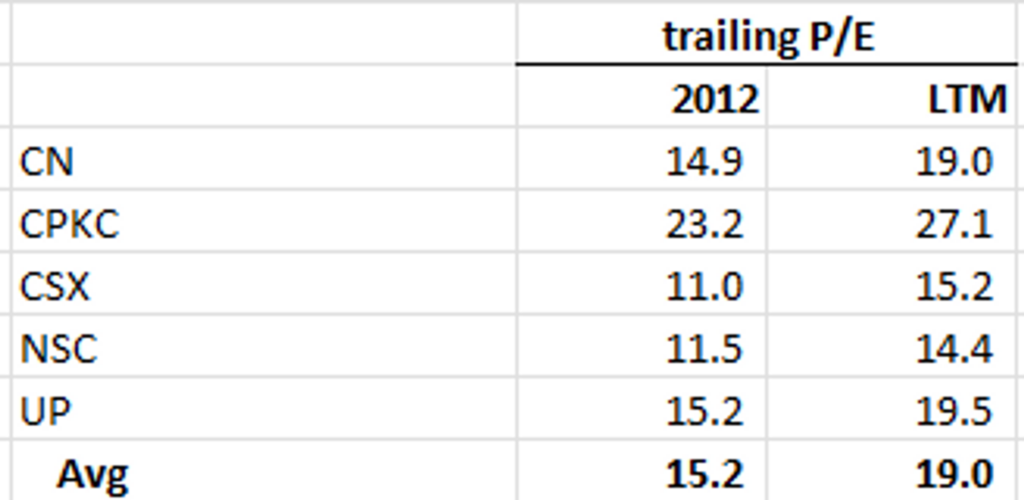

All the Class 1s except CN have compounded by low-teens and outperformed S&P 500 over last ~decade.

Around ~2.5% of that compounding has come from multiple expansion:

The remaining ~11% tracks per share earnings growth.

You’ll notice that CP stands out as the most richly valued Class 1 by far. I can certainly understand the valuation at the end 2012. CP had the lowest operating margin and ROIC, but Hunter Harrison had just come onboard as CEO to turn things around. Given his success at CN, there was strong reason to believe profitability would inflect. And that’s exactly what happened. The once ailing railroad went on to grow earnings per share by ~16%/year over the next decade, faster than any of its peers. Now it generates the highest returns on capital of the Class 1 rails. Even with its premium starting valuation, CP’s shares have compounded a much higher rate than peers.

But is it reasonable to expect similar performance over the next 10 years?

On the one hand, CP is steered by Keith Creel, who was Hunter Harrison’s right hand man for 30 years and has become an industry legend in his own right. With its recent acquisition of Kansas City Southern, CP is an obvious beneficiary of nearshoring. Between “base growth” (3%-4%), inflation+ pricing (3%-4%), and synergies (2%-3%), management is guiding to high-single digit revenue growth from 2024-2028 at the low end. Moreover, KCS only started its PSR journey in 2019, so on top of the revenue synergies maybe CP also surprises us with margin accretion from low-hanging productivity gains.

On the other hand, there’s a big difference between paying 23x for earnings that are about to massively inflect and paying 27x earnings that have already massively inflected! And if the low-end of CPKC’s revenue guidance for 2024-2028 (8%) is ambitious but plausible – adding ~2%/year of revenue synergies to the trailing 10-year ex. coal revenue CAGR gets you to ~7% – the high-end (11%) feels far-fetched. To put this in perspective, like CP+KCS, the last 2 major Class 1 mergers – between Burlington Northern and Santa Fe in 1995 and between Union Pacific and Southern Pacific in 1996 – also created more direct route routes across more O/D pairs. In the 4 years following their mergers, BNSF grew by 3%, UP by close to 5%. Over 10 years, both companies grew by 6%. So considering CP’s standalone historical revenue growth rates (5% over the last 10 and 20 years) and the growth rates generated by other Class 1s post-merger, the base rates supporting 8%-11% growth don’t seem all that favorable.

More generally, railroads have talked a big game about improving growth for years and years. But the fact of the matter is that Operating Ratio, while sometimes derided as a crass oversimplification of what really matters, seems to be the singular metric that both matters and is reliably under a railroad’s control. And the extent to which it can improve from here, after steadily compressing over the last 20 years, is a key question hanging over the industry.

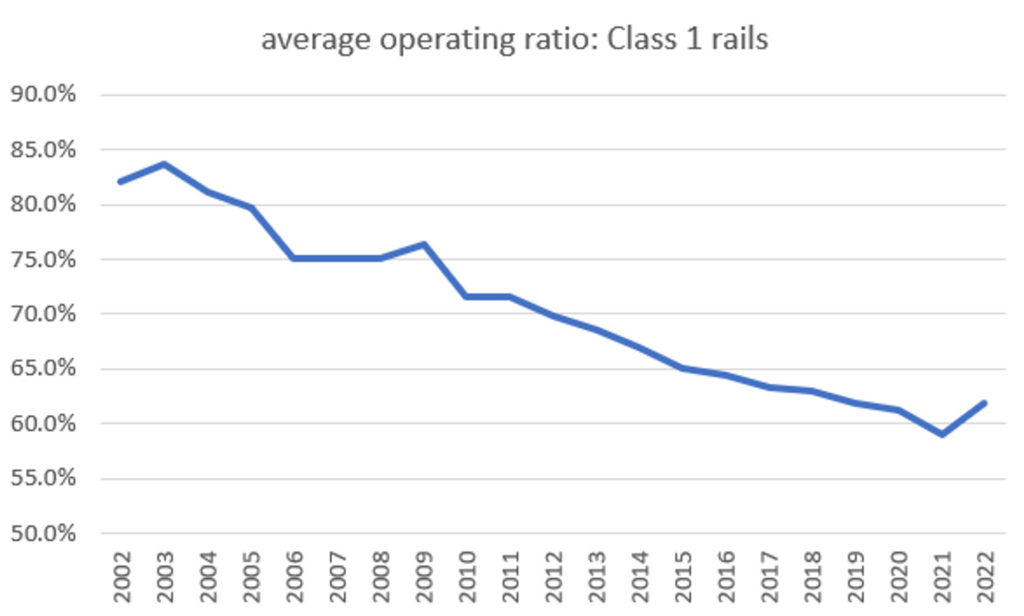

In the decade from 2002 to 2012, the average Class 1 OR improved by 12 points, from 82% to 70%. Over the following decade, a period during which all major railroads (except BNSF) adopted PSR, it improved by just 8 points, from 70% to 62%. With everyone now at least 3 years into their PSR programs, is it reasonable to think the industry enjoys comparable gains over the next 10 years?

Tying OR to its operational drivers can be a somewhat helpful intuition pump…for instance, CSX’s former CEO Jim Foote noted back in 2019, when the railroad was managing an OR of 60%, that a reported velocity of 20mph implied their trains were idling at yards 60% of the time, given that a train in motion travels at speeds of ~50mph. Though I’m then left wondering what a reasonable idle percentage should be, as well as the quantitative impact that improving it has on OR? I’ll just say that generally speaking there always seem to be more ways to optimize complex operations. The constraints to doing so are often rooted in culture than in physics. After decades generating 10%-15% EBIT margins, I’m sure the dudes running large railroads in the ‘90s were convinced they had hit a natural OR floor. Who among them would have believed a network with more than 20k+ route miles could get hit low-60s? CP’s OR trundled along between 75 and 80 for a dozen years. Then Hunter Harrison lobbed off 20 points in just 4. And if you’ve ever researched Danaher, you’ll no doubt have heard stories of managers at acquired companies, cock sure that they had run the productivity well dry after decades, stunned at the gains subsequently realized through DBS. Alongside process improvements, the industry has a long history of applying technology to reduce fuel and maintenance costs – devices that automatically shut down locomotive engines to reduce idling, GPS coordinates and velocity data to better predict arrival times, machine vision systems that inspect components while the train is in motion, sensors that pickup the irregular sounds of defective bearings.

At the same time, one reason I find it hard to gauge the pace of improvement from here or to even know what a realistic OR might be is that we don’t have a benchmark to anchor to. In 2011, if you were looking at a railroad with an 80%+ OR, you could look to CN, who had sustained sustained an OR in the 60s for more than a decade, as an aspirational anchor. That’s especially true if this railroad were CP, who ran a similar east-west network in Canada. I completely get now why Pershing Square, with Hunter Harrison in tow, found this opportunity so compelling. Today though, you’re running a mile before knowing it can be done in under 4 minutes. There is no outlier OR to to show us what’s possible. A few railroads reported 55% ORs, but only for a year or two. All the rails are bunched up with ORs around 60. The difference between the highest and lowest OR is just 6 points compared to 18 points in 2011.

We should also consider regulatory obstacles. The STB is now headed by a particularly enthusiastic Chairman, Martin Oberman, who was appointed to the role by President Biden in 2021 and, according to a statement he released last year amid railroad disruptions “has prioritized enhancing competition in the nation’s rail industry where too many rail customers are captive to a single large railroad and for that reason often lack bargaining power to obtain better rail service and competitive pricing for their shipments”. The effort to “enhance competition” is expressed through a renewed interest3 in Reciprocal Switching rules, which require an incumbent railroad to transfer traffic to a competing railroad at a nearby interchange point in return for a fee. For the rules to take hold, historically shippers had to prove that a rail carrier had engaged in anticompetitive conduct, which was apparently very hard to do. Now, Oberman is proposing a lower hurdle that requires the shipper seeking RS relief to merely show that it is “practicable and in the public interest” or “necessary to provide competitive rail service”. The proposal basically introduces competition by giving captive shippers the opportunity to source service from a nearby alternative carrier.

You can see why the Class 1 railroads hate this. They make their money hauling as much freight for as long as possible and, assuming certain conditions are met, the new RS proposals might require a railroad to transfer profitable traffic at the point where a competitor can move it more efficiently and at lower cost (according to rails.com, at an STB hearing in March ‘22, Oberman criticized Union Pacific for routing chemical traffic from the Gulf Coast to the East coast by interchanging with competing rails at St. Louis, adding 335k extra miles a year unnecessarily).

Railroads retort that their networks have emerged through a long series of considered trade-offs that take into account differential route density, balance, and terminal congestion, and that re-shuffling the decks would throw everything into disarray, especially now that most everyone has adopted some form of precision scheduling, which requires a degree of resolution into the goings on of a network that is obfuscated by arms-length switching obligations. Accommodating interchange with competing carriers could require unplanned re-allocation of resources on short notice. The uncertainty unleashed by the proposed RS standards could disincentivize investment. Why build more terminal or storage capacity if you could be forced to interchange a competing rail’s traffic there or if you can’t accurately estimate volumes? In essence, the industry argues that any putative benefits from greater competition would be more than offset by coordination costs, operational complexity, and ultimately degraded service levels.

But the rail industry is prone to histrionics when it comes to resisting unfavorable change, like a soccer player wailing in exaggerated agony at the slightest contact. Canada has been subject to regulated “inter-switching” since the early 1900s4, and CP and CN have long been among the two most efficient players. Also, reciprocal switching at flat fees are a common outgrowth of major US railroad mergers. Union Pacific and Burlington Northern were both forced to grant significant traffic rights to competing rails as conditions to acquiring Southern Pacific and Santa Fe, respectively, which did nothing to impede their productivity gains in the ensuing years.

In 2016, the last time reciprocal switching reform was seriously discussed in the US, Hunter Harrison remarked that in Canada few customers took advantage of “inter-switching” (as it’s known there) and predicted that just as inter-switching had “no impact” on CP’s business in Canada, it would be a non-event in the US. Of course, whether that’s true will ultimately turn on the details (we’ll know more by the end of this year or early next year). But given the systemic importance of this industry and the unpredictably large ripple effects that seemingly minor disruptions can have across networks and thus the industrial economy, I expect common sense and incrementalism to prevail over over ideology and radical change, especially now that the service disruptions of last year have largely corrected. If I had to guess, I’d say RS rules will be a fallback that shippers rely on to address blatant anticompetitive abuses rather than a bargaining tool used in the everyday course of business.

But even assuming the Oberman is more bluster than bite, I’m still left wondering how much margin expansion is reasonable from here. Let’s be optimistic and assume CPKC compresses OR by 10 points (including cost synergies from the merger) and the others do it by 8 points over the 7 years, which is about as much improvement as the industry realized over the last decade. Further, let’s assume CPKC grows revenue by 8% a year and that the rest of them grow 1 point faster than they did over last decade, ex. coal (i.e., CSX grew ex. coal freight revenue by 2.5% from 2012-2022, so I assume they grow by 3.5% over the next 7 years). With onshoring trends taking hold and ESG considerations rendering trains (4x more fuel-efficient than trucks) a more attractive transport option, it could be reasonable to expect somewhat faster growth in the years ahead, who knows. Still, I consider these growth rates more optimistic than realistic as railroads have in the past gestured at themes – whether that be rising meat consumption in emerging markets, crude-by-rail, frac sand, biofuels, energy reform in Mexico, electronic logging devices tightening truckload capacity, etc. – that, however promising, have proven small fragments in the massive mosaic of the anemic industrial economy.

With industry capex running about 1.5x-2x depreciation over the last decade, only about ~70% of net income has dropped down to free cash flow on average over time, though there is wide range across names, with CP at ~60% on the low end and UP at 80% on the high end. Let’s say “normalized” conversion is 75% and slap a year 7 free cash flow multiple of 30x on CPKC, 25x on CN and UP, and 20x on CSX and NSC, which roughly corresponds to their ordinal valuation ranking today (simplistic, I know…let’s just get through this ;). After applying those rosy assumptions, you’re still only compounding 11% on CN, 10% on CPKC, CSX, and NSC, and 9% on UNP. And let’s not forget that capital turnover (revenue/capital) has generally trended down over time and that OR gains have only gone toward compensating for those declines to maintain ROIC.

(I made an educated guess for CP in 2021 and 2022)

Were capital turnover continue to fall without a corresponding OR offset, returns on capital would deteriorate and these names could be hit with multiple compression on top of lower than expected earnings.

In short, the railroads are a mature, consolidated industry, more or less prohibited from large scale M&A. What’s mostly in their control boils down to capital allocation, which is more or less undifferentiated across Class 1s and frankly hard to screw up too badly in an industry with such high levels of long-term business certainty (we don’t need to handicap “metaverse” type bets that someone like Meta might feel forced to make to fend off existential platform concerns), and operations, where I think margin expansion will continue but at a slower pace as the most profound PSR-fueled efficiency gains have likely already been realized.

Class 1 freight rails: part 1 – historical overview

Class 1 freight rails: part 2 – freight types, route structures, and growth

Resources

The Great Railroad Revolution by Christian Wolmar

North American Railroad Family Trees: An Infographic History of the Industry’s Mergers and Evolution by Brian Solomon

(I drew on Great Railroad Revolution and North American Railroad Family Trees for much of the historical content contained in this post. Both books are great resources if you’re interested in understanding how the North American rail industry has evolved over time, starting way back in the 19th century)

Riding the Rails: Inside the Business of America’s Railroads by Robert D. Krebs ****(memoir of former BNSF CEO. Interesting inside look at Burlington Northern, Santa Fe, Union Pacific, and Southern Pacific during the ‘80s and ‘90s)

RAILROADER: The Unfiltered Genius and Controversy of Four-Time CEO Hunter Harrison by Howard Green (a look at the life and legacy of legendary railroader, Hunter Harrison. If you’re a generalist interested in rails, this is probably the book you’ve read)

CSX: The Old School “Monopoly” by Mostly Borrowed Ideas (nice overview of CSX and the North American rail industry, including some useful charts and maps)

Colossus Business Breakdowns – Matt Reustle – Union Pacific: Long Train Runnin’ (another good overview of the industry)

Disclosure: At the time this report was published, accounts managed by Compound Insight LLC did not own shares of any company mentioned. This may have changed at any time since

- as relayed by Howard Green in Railroader.

- from Railroader by Howard Green; Kindle Edition, p. 102

- reciprocal switching has been the subject of intense industry debate several times over past decade.

- one of the early objectives of inter-switching was to avoid excess rail capacity. It is more efficient for railroads to interchange traffic than to have every railroad build capacity everywhere.