Business updates, SAMPLE POSTS

scuttleblurb business update (2020)

I recently did an interview with my friend @LibertyRPF. It will serve as a substitute for my 2020 year-end review since it contains everything I wanted to say (and more).

With permission from @LibertyRPF, I have reproduced the interview below. You can access the original here.

Interview with David Kim a.k.a. Scuttleblurb

𝕊𝕡𝕖𝕔𝕚𝕒𝕝 𝔼𝕕𝕚𝕥𝕚𝕠𝕟 #𝟙

Scuttleblurb is one of my favorite sources of investing/business information, and its creator, David Kim, is one of my favorite people I’ve met online (we haven’t met in person yet, but I hope to fix that someday… hurry up, Pfizer!).

As a writer, he’s who I want to be when I grow up.

He dives deep into companies and industries, but not in the typical way of many financial writers: He’s not trying to pitch you, he’s not starting with a conclusion in mind that he’s trying to justify by cherry picking info. He immerses himself in a business for a while and then reports what he finds about industry dynamics, management quality, unit economics, competitive advantages, how historical developments have made things the way they are today, etc.

He’s more ‘Magellan writing about his voyages’ than ‘salesman trying to get you to buy that shiny Dyson’…

His pieces often conclude on some shade of gray, without a clear call to action or price target, but I like that. It’s how the real m’f’kin’ world works.

Enough from me, let’s go to David (I’m in bold):

Hi David, thanks for doing this, I really appreciate it! I know you must have your hands full between the piles of transcripts and 10Ks and the new twins.

Thanks back. I very much enjoy your eclectic newsletter. It’s one of the first things I read in the morning. I also appreciate that we’re doing this interview in writing, which I much prefer to speaking.

I don’t want to assume that everybody reading this already knows you and reads your stuff, so could you start by telling the reader who you are, what’s your background and how you got to where you are now, and what’s your day job these days?

These days I write the scuttleblurb blog and manage a small fund. Prior to doing either, I was a research analyst at a L/S equity hedge fund.

The reason I started scuttleblurb is that I had just launched a fund with no prospective investors and my wife Maria and I needed a way to pay the bills. I write research notes as part of my investment process, and I put those notes online hoping people would pay to read them. Very few did.

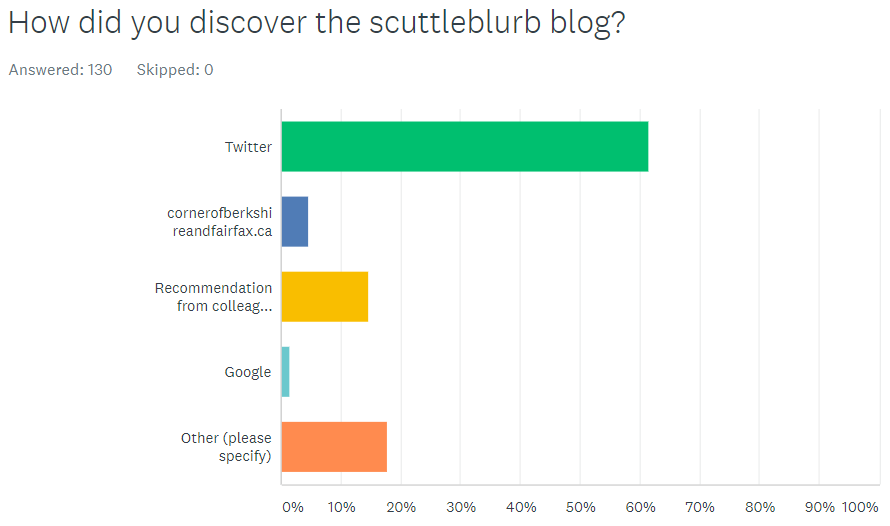

So it was mid-2017 and we were stuck. scuttleblurb was going nowhere. My big idea for getting people to discover and then pay for my work was sending personalized emails and handwritten letters (really) to fund managers and analysts, with coupon codes and free trials and such. I spent a few thousand bucks advertising on marketfolly, which worked all right, but otherwise scuttleblurb got no traction. Maria and I just had our first baby and we were scraping by on her teaching salary plus income from a condo I was renting out as we weighed my non-existent career options. Then you somehow discovered my blog [Finding stuff is what I do! -Lib] and tweeted a link to one of my posts. Then so did @Bluegrasscap, @Intrinsicinv, and a few others.

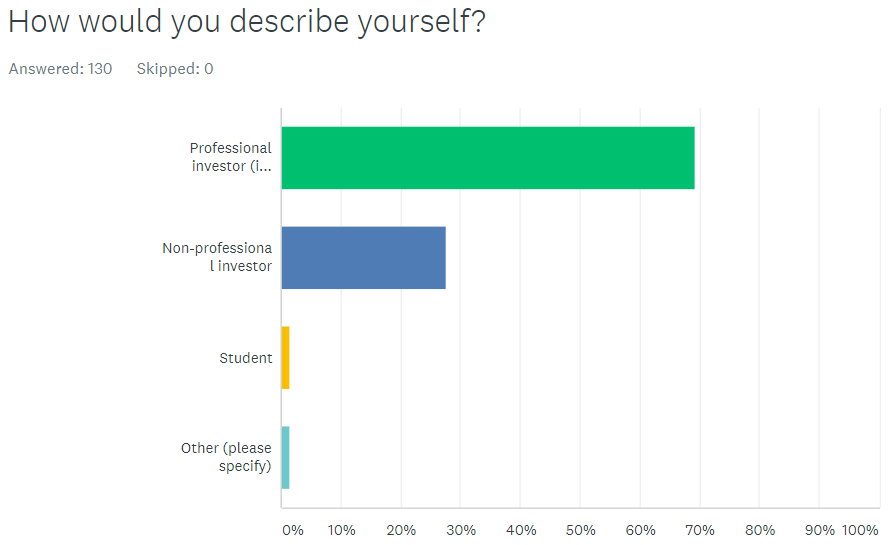

I didn’t use Twitter at the time. I had a zombie account with like 40 followers that I barely touched. So you can imagine my surprise when the blog started to gain followers on this geeky community I had never heard of called FinTwit. I kept writing, people kept tweeting my posts, and here we are. I estimate that more than 70% of my subscribers have come from Twitter word-of-mouth. I’m so grateful for FinTwit. This community lifted me on its shoulders when things looked utterly hopeless. I honestly get a little choked up thinking about it.

What fascinates me most is your research process. You do such a good job, I’m curious what techniques I may be able to learn from you, though I suspect that there are no real tricks, just lots and lots of reading, asking questions and then tracking down answers, figuring out what is most important to focus on, etc… Can you describe what the research process is like for one of your long posts or series of posts?

Like every analyst, I read SEC filings and transcripts, Google, watch relevant YouTube videos, talk to management (usually IR), and do the same for competitors and anyone else of note in the ecosystem.

I write up every company that sparks my interest, whether I find the company an attractive investment opportunity at the time or not. I recall you mentioning that you research companies that speak to you regardless of how pricey they are and then keep those companies on a watchlist so that you’re ready to pounce when valuation approaches something reasonable. I’m the same way.

Speaking from personal experience, most investment funds don’t let their analysts do deep dives on interesting companies trading at uninteresting valuations. Try telling your PM that you’re going to spend a month studying such-and-such industry because you find it interesting but there’s probably nothing to buy at the moment and there may never be. See how that conversation goes. It’s nice to be able to set your own research agenda.

But in the time it takes for a sane valuation to arrive you may find yourself forgetting what it is you found so interesting about the stock in the first place, so it’s useful to have a write-up to refer back to. For the sake of efficiency, many analysts jot down bullet points and preserve a folder of notes, but there’s something about long-form prose. I can’t explain the underlying mechanics of how it happens, but oftentimes the very act of writing sparks an idea and exploring that idea in more detail leads me to an important point that I don’t think I would’ve grasped otherwise. This was true with Align Technology [Link for SB members. -Lib], which on the surface looked like a static collection of expiring IP selling a commodity product whose economics were just waiting to be siphoned away by low-end clear aligner competition. Writing led me down the track of thinking about Align as a system of reinforcing pieces – data from case starts enabling more complex malocclusion cases; vertically integrated software and hardware crowding out competing solutions and saving orthodontists chair time; a strong brand synonymous with clear aligner treatment – that in concert fueled more case starts, data, manufacturing process improvements, orthodontist adoption, etc. (there’s an argument to be made that Smile Direct Club is re-setting the basis of competition and presents the first major competitive threat to Align in over a decade, which I’ll likely touch on in a future post).

I don’t mean to sound prescriptive. I think many people find writing to be mentally taxing and maybe the time spent writing would be more efficiently put to use elsewhere. I just happen to enjoy writing, it’s like therapy for me, but I don’t want to promote an approach that may not make sense for most others.

I’m the same. Writing is very hard even if I enjoy it, but it’s also very fruitful because it’s hard. Writing is hard because thinking is hard, and on the page the gaps in logic and missing pieces of the puzzle can’t be hand-waved away as easily, while with what I’d do otherwise — the path of least resistance — my brain would probably skip over a lot more holes and leave some interesting doors unopened.

As far as what I focus on, I spend a lot of time trying to understand a company’s advantages or the advantages it might build up to. Earning a decent return on the growthy compounders I often write about at today’s valuations means you have to be right about the secular trend, the state of competition, and the ability to execute/adapt. Those are basically the 3 core elements. The secular trend is often the safe bet because it’s readily apparent to all that more compute is moving off-prem, that connected TV is taking share, that telehealth adoption is infiltrating healthcare, that semiconductor consumption is accelerating, and so forth, whereas the state of competition over the next 5-10 years can seem much more distant and abstract. The boundaries of competition can be fluid, especially in tech, and justifying current valuations often means assuming the company successfully trespasses into adjacent, already occupied territory. Maybe for companies with low enough market caps, you can lean on the “there’s plenty of TAM to go around and I just need to be directionally right” defense, but compounding at 20% over the next 7 years on, say, Snowflake, a $75bn company trading at 150x revenue (or wherever it’s at now), means being right on the specific state of the data management ecosystem and Snowflake’s ability to capture value within it.

The other thing I try to do is provide context, nuance, and caveats around different explanations in order to avoid overfitting concepts and mental models. LendingTree [Direct link for SB subs. -Lib] might look like a classic marketplace that scales through cross-side network effects between lenders and borrowers, but I think it’s more aptly described as a sophisticated marketing coop that arbitrages online ad inventory. Live Nation [Direct links for SB subs, #1 and #2. -Lib] is often described as a flywheel, but it looks more like a bundle that loss leads through a promotions biz. Sometimes network effects are relevant but they’re not really the moat they seem to be. Equity exchanges enjoy network effects in that buyers attract sellers and vice-versa, and the growing concentration of liquidity narrows bid/ask spreads, in turn drawing more buyers and sellers. But in the mid-2000s, as legacy equity exchanges lost regulatory protection, non-exchange trading platforms stole enormous share through superior technology and the backing of powerful brokers. Yelp has network effects in theory, but Google guards the front door and absorbs most of the value in local search. Symantec, Cisco, Palo Alto Networks [Direct link for SB subs. -Lib], and other cybersecurity vendors monitor trillions of telemetry points, but the resulting data network effects seem to be quickly arbitraged away, and that’s something to consider when evaluating the explanatory weight of network effects for the post-2010 breed of cloud native, zero-trust vendors.

By overapplying cherished concepts, you risk minimizing the importance of other factors or confirmation biasing your starting theory. An analyst begins to treat the diligence process the same way an attorney might, selectively gathering evidence to defend a starting hypothesis rather than considering the case from multiple angles to surface the best explanation. Maybe mismatches between changes in balance sheet items and the cash flow statement confirms your starting thesis that Company X is a fraud, and you so badly want this to be true that you don’t give due consideration to another plausible explanation….that under GAAP balance sheet items are translated from local currency to USD at period-end exchange rates while the cash flow statement is translated using monthly averages, which can create large discrepancies between the two during periods of volatile FX movements , discrepancies that are accounted for in shareholder’s equity.

And sometimes you dismiss the existence of moats in places where you don’t expect to find them. In Surfaces and Essences, Douglas Hofstadter talks about how a given item can belong in many unrelated categories depending on context. The image of a basketball rolling, for instance, is more readily accessible than that of a basketball floating because most of our observations and experiences related to basketballs have been on the ground. We think of airlines as intrinsically terrible businesses, loaded with high fixed costs, selling a commodity product, prone to price wars and periodic bouts of bankruptcy. But the same set of conditions may create advantages for disciplined airlines like Ryanair [Direct link for SB subs. -Lib] and Wizz Air [Direct link. -Lib], who at the expense of bloated competitors, leverage superior unit costs to maintain low ticket prices, generating more passenger volumes on a fixed cost base, fueling better landing fees with airports and volume discounts on aircraft, thereby reinforcing the cost advantage. This starts to look like a flywheel, a designation that we typically reserve for consumer internet and tech companies.

The set of concepts and mental models that you have at your disposal will evolve over time and with experience you get better at not only drawing on the right ones but doing so in a way that is unfettered by preconceptions, proportionate to the case at hand, and peppered with the appropriate caveats.

I can’t tell you how many bearish SaaS pitches I read 5-10 years ago that were predicated on accounting-based red flags and quarterly billings weakness, factors that were just absolutely swamped by massive secular tailwinds (this has pissed off some really smart low-multiple investors because the only thing worse than being wrong is seeing someone who you perceive as less sophisticated and experienced than you being right at your expense). The Bezos flywheel napkin sketch helped me understand the reflexive properties of scale economies, but then I found myself applying the sketch to areas where it probably didn’t belong, and in recent years I’ve chilled out a bit and drawn on the concept in a more nuanced way.

Proportionality is important to sound analysis. You don’t want to start seeing flywheels and fraud everywhere you look. You don’t want to diminish the tsunami of ad spend moving to connected TV because (gasp) Trade Desk’s [Direct link. -Lib] receivables outpaced revenue this one quarter; nor do you want your enthusiasm over connected TV blind you to the possibility that surplus in that domain may eventually concentrate inside walled gardens. You don’t want your commitment to low multiples steer you away from companies with compelling unit economics that are losing money as they invest in growth; nor do you want to stretch one assumption after the next to validate a purchase of a company you love (assuming, of course, that you’re optimizing for risk and reward when investing, which you may not be and that’s totally fine). By the way, congrats your investment in The Trade Desk. I sold 40% ago, oops. Why didn’t you tell me the stock would go from $500 to $800 in like a month….thought we were friends, geez. [Well, I sold ALGN a while ago and didn’t get the rebound on that one, so you win some and lost some ¯\_(ツ)_/¯ -Lib]

If it’s not an industry you already know, how do you first attack it and is it ever overwhelming? Have you ever given up entirely on something you wanted to write about because it’s just too complex?

It’s always overwhelming. My imposter syndrome is usually up to here because I cover such a wide range of companies and most of the industries I want to write about reside well outside my existing circle of competence at the time I want to write about them.

To be clear, I don’t mind being the dumbest guy in a room of specialists. I have no interest in being the sapient thought leader [I had to look up ‘sapient’, good vocabulary! -Lib] with big sweeping ideas of what software or media looks like in 10 years. I see myself more as the plucky interloper at a house party, probing one room, then the next, trying to make sense of what’s going on in each. But the feeling that I have no business charging people to read something I’ve written given my lack of background knowledge and expertise doesn’t ever go away. I just do my best to push through it and trust that approaching the work with intellectual honesty and an open mind will compensate for my considerable knowledge deficits and yield something that people want to read.

What’s your Big Picture vision for Scuttleblurb? What are you trying to give the reader, and who is your ideal reader? What kind of mindset and expectations should someone have going in?

The ideal reader is someone who derives intrinsic enjoyment from analyzing businesses, regardless of sector, even without the carrot of an actionable investment idea. If you’re looking for stock tips, please don’t subscribe [Subscribe anyway, and then get over that urge. You’ll be better off for it. -Lib]. You will feel ripped off and I will feel bad. I try to be very clear about this up front, in the “About Me” page and in the “Subscription” page, though I think some folks may still be frustrated or confused by the absence of price targets and buy/sell recommendations. My posts will often include a back-of-the-envelope valuation section, like “under such-and-such assumptions, here are the returns you can expect”, but the point of that is to offer a sense of what you need to believe to earn 10%, 15%, or whatever. You can make up whatever numbers you want. What I’m hoping to do is provide as honest a qualitative context as possible to inform your assumptions.

Some time back, a subscriber commented that I should focus on names in which I have a high degree of conviction. I think following this recommendation would yield a barren website because there are so few stocks that meet that criteria for me. Who knows, it might even tempt me to dishonestly convey conviction where it doesn’t exist for the sake of placating readers. But more importantly, it would be out of character. I don’t really have the emotional makeup to be a “high conviction, bet-the-farm” investor and I don’t really fall in love with the companies I analyze (which can be both an asset and a liability). I could act otherwise, but over time you’d see through the facade.

I think that we tend to remember the results we see and forget the mistakes we avoid. Convincing your PM not to buy a stock that stock goes to zero will not earn you the same glory (or bonus) as convincing your PM to buy a stock that doubles. The PM doesn’t have the same felt sense of profit and loss on the stock he avoids that goes to 0 as he does on the stock he owns that doubles. Similarly, a scuttleblurb writeup that prompts a position size reduction will not get the same credit as a newsletter “high conviction list” that prompts a new purchase, even if the losses prevented in the former and the gains realized in the latter are the same. The fact of the matter is that most people want black-and-white buy/sell recommendations. They want conviction. I offer neither. This can be frustrating.

There’s value to what I offer but it’s hard to quantify. I guess I would say don’t purchase a scuttleblurb subscription hoping to make money on actionable stock ideas. Do so because you want to get a little smarter about certain businesses than you are today and trust that over the course of your career as an investor, being a sharper business analyst will pay dividends.

Do you have a long-term vision for the site that is different from what it is today?

Nope.

Almost a year ago, you wrote about how Scuttleblurb was doing as a business. I don’t know if you’re planning to do the same thing this year, and I don’t want to steal your thunder, but I’m curious to know how things have been going? Has the pandemic hurt or helped your business? Are you finding that the more you grow, the more growth rate accelerates because you’re getting more name recognition in the space and you have more subs spreading the word to potential subs?

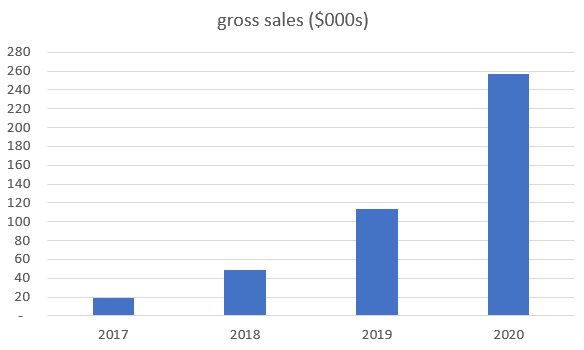

I think I’m just going to link to this interview for my year-end review. It has everything I want to say. I don’t know if the pandemic has hurt or helped the blog. Things have been going pretty well. Scuttleblurb passed 1,000 paying subs this year and it looks like my gross bookings in 2020 will be about double what they were a year ago. Bookings have gone from $19k in 2017 to $49k in 2018 to $114k in 2019 to what’s looking like maybe $230k-$235k this year (vs. $223k LTM through Nov 8), so while the growth rate has decelerated, it’s nonetheless been so much stronger than my expectations. [Very happy for you, you deserve it! -Lib]

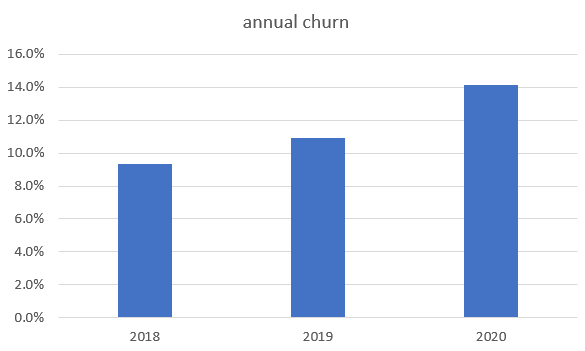

But while growth has been strong, my annual churn rate has spiked from ~11% in 2019 to what’s looking like ~high-teens this year. Part of this I think is just that as my audience has grows, incremental subscribers are not going to be as passionate about my work as the early adopters.

Another contributing factor is competition. There has been an explosion of Substack newsletters launched this year, many of which focus on tech and media analysis/strategy. It’s like all the cool kids are giving hot takes on Joe Rogan going to Spotify and Nvidia buying ARM or providing commentary on Stripe, Ant Financial, Snowflake, Shopify….and then here’s me off in the corner writing about a 100+ year-old company that sells bacteria to dairy processors [Direct link to Chr. Hansen & Novozymes post. -Lib]. Very off-trend. I write about SaaS, consumer internet, and other trendy stocks, sure, but not reliably so.

But the market for tech/media business analysis, while hot, is also crowded. When Stripe files to go public, your inbox will no doubt be flooded with Substack commentary. You do not need another newsletter breaking down that S-1. This is not an area where I can differentiate, nor do I care to. And there are so many talented writers with fast minds and fingers who can do the daily run much better than I ever will. I am a slow, plodding thinker. It really takes me a while to come up with something that I think is worth publishing. Sometimes I will sit on a write-up for over a year because it’s just not worth reading. I suck at extemporaneous thought and can’t think of clever things to say on the fly. I wish it weren’t like this.

Anyways, everyone’s now hip to the notion that customer obsession is the way to value creation, so what a real business publication would do upon seeing churn spike as mine has is find a way to write about what interests their readers most. But the truth, and this will hardly endear me to your audience, is that I spend no time thinking about what my subscribers want to read. I have always treated scuttleblurb as a personal research journal rather than a business, a way to pursue my own personal interests and get paid in the process. I’m quite sure that forcing myself to write about popular topics merely to attract subscribers would be the beginning of scuttleblurb’s end. And so my analysis and writing has got to be strong enough to compensate for incomplete overlap between my interests and those of my readers.

Sometimes the overlap is just too minimal. No amount of quality analysis on the consumer credit bureaus is going to satisfy subscribers who just want to read about enterprise SaaS. And someone looking for stock tips is not going to be satisfied with case studies. If subscribers churn off for reasons like those, so be it. I’m cool with that. If they’re cancelling because they’re looking for well-written, quality analysis and aren’t finding it on scuttleblurb, that’s a problem. I hope most of my churn is coming from the former, but I can’t really be sure.

Thanks so much for doing this, there’s so much gold and wisdom in there, it’s a masterclass masquerading as an interview. Take care my friend!

12/31/2020 update: scuttleblurb stats

Great content, thank you

Great stuff! I really enjoy your work 🙂 thank you for doing what you do!

Excited for you! Great interview.

thanks Meng!