What are scuttlebits? Nobody talks about Charles Schwab anymore, but just two and a half short years ago everyone had an opinion…and if you roamed the Twitter hellscape back then what you found was that the most amplified takes converged on one conclusion: Schwab was teetering on the brink of collapse. To recap: the most […]

[scuttlebit] Charles Schwab is so back

Posted By scuttleblurb On In scuttlebits,[SCHW] Charles Schwab | Comments Disabledyet another Schwab post

Posted By scuttleblurb On In [SCHW] Charles Schwab | Comments Disabled(our regularly scheduled life sciences programming resumes in a week or so) Schwab lost a shitload of deposits last quarter. Not as many as the most vociferous bears feared (hoped?) but still, a lot, more than I expected. Across on-balance sheet and BDA balances, it looks like $86bn, or nearly ~18% of the 4q22 deposit […]

quick follow-up on Charles Schwab

Posted By scuttleblurb On In SAMPLE POSTS,[SCHW] Charles Schwab | No CommentsOriginal post: some thoughts on Charles Schwab [4], published Mar. 12, 2023:

In The Media Very Rarely Lies [5], Scott Alexander writes:

the media rarely lies explicitly and directly. Reporters rarely say specific things they know to be false. When the media misinforms people, it does so by misinterpreting things, excluding context, or signal-boosting some events while ignoring others, not by participating in some bright-line category called “misinformation”.

I was reminded of this phenomenon over the last few weeks after reading much of the commentary about Charles Schwab. Most of the long-form Schwab write-ups and Schwab-related tweets I read made the same point: marking all of Schwab’s securities to fair value wipes out nearly all of its tangible book value. This is factually true. The authors are not lying. But they are “misinterpreting things” and “excluding context”. As I hope I made clear in my last Schwab write-up, you can’t express a view on solvency without expressing a view on cash sorting. If no depositors cash sort out of the bank, then Schwab’s investment securities, predominantly Treasuries and Agencies, will pull to par as they mature and everything is fine. If all depositors cash sort at once, then Schwab Bank will be forced crystallize all its unrealized losses and find itself in ruin.

If you want to say “scuttleblurb, you’re delusional. I think Schwab will have to tap into the HTM bucket as 80% of deposits flee and (for whatever reason) liquidity backstops are unavailable, which in turn will convert huge unrealized losses into realized losses, impair their capital ratios, and either force them into receivership or into raising boatloads of capital on massively dilutive terms“, that’s great! This is the right framework for thinking about insolvency in this particular case.

Of course, I thought the chance of an SVB-style debacle was very low (say, less than 3%) at the time of my last post and I think the probability is even lower now with the Fed’s the Bank Term Funding Program (BTFP) [6] in place. The BTFP lets Schwab and other federally insured banks to access funds against the par value of Treasury and Agency collateral. The advances will be made available for a term of one-year at a rate of ~5%1 [7].

The day after the BTFP was announced, Schwab released its monthly Activity Highlights [8], which included the following statement:

We have access to significant liquidity, including an estimated $100 billion of cash flow from cash on hand, portfolio-related cash flows, and net new assets we anticipate realizing over the next twelve months. We believe we have upwards of $8 billion in potential retail CD issuances per month, plus over $300 billion of incremental capacity with the Federal Home Loan Bank (FHLB) and other short-term facilities – including the recently announced Bank Term Funding Program (BTFP).

To briefly recap, at year end Schwab’s immediate sources of funds included:

Cash: $40bn

AFS govies maturing in < 1 year: $22bn

Other AFS-securities: $123bn

On top of all that, they can now tap into $176bn of funding by posting HTM securities, all US agency MBS, to the BTFP.

That’s more than $300bn of liquidity against Schwab’s $367bn of total bank deposits, only $73bn of which is uninsured. In an interview with The Wall Street Journal [9] last Thursday, CEO Walt Bettinger affirmed, “There would be a sufficient amount of liquidity right there to cover if 100% of our bank’s deposits ran off,”….“Without having to sell a single security.” So the risk of a catastrophic liquidity strain that tips Schwab Bank into receivership seems very very low. And in the unlikely event that half of total deposits cash sort out of the bank and Schwab is forced to liquidate all its AFS securities, its Tier 1 leverage ratio would actually improve (from 7.1% to 8.1%): the excess capital released as the balance sheet shrinks exceeds the after-tax value of realized losses on the AFS securities being sold.

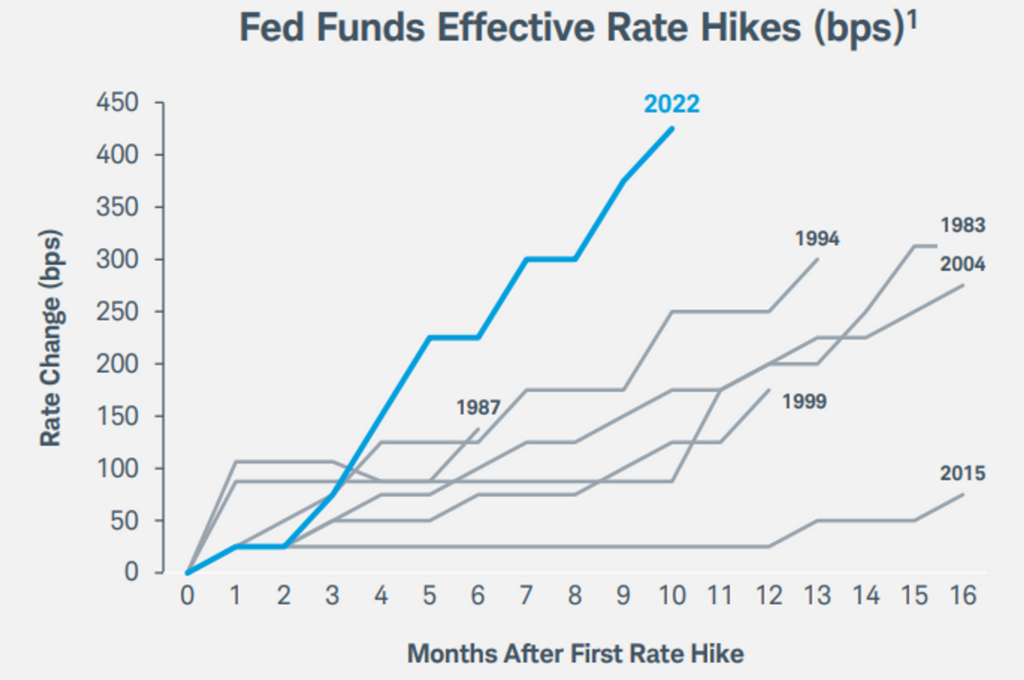

But even if Schwab can survive a deposit run, it still faces an earnings challenge. The most vigorous proponents of this view are puzzled that anyone would keep brokerage cash in deposits earning ~0% when they could, with just a few clicks, invest that cash in one month T-bills earning ~4%. The pace of rate hikes is like nothing we’ve seen in the last 40 years and with broad public awareness of inflation and rates, the consumer is likely far more sensitized to rate hikes today than they were during the far more measured rate hiking cycle of 2015-2019, which management often points to as a comp for cash sorting dynamics.

Moreover, while 80% of Schwab’s deposits are FDIC-insured and come from 34mn brokerage accounts that represent a wide cross section of the US mass affluent – making them far more diversified and stable than SVB’s, which were concentrated in the accounts of cash burning startups funded by herdlike VCs with Twitter megaphones – they are also qualitatively different from primary checking accounts that consumers use for day-to-day purchases. I suspect that the brokerage account clients that own these deposits and the RIAs who manage half of Schwab’s clients’ assets are more attuned to visible and easily attainable sources of incremental yield than the average depositor at some regional bank.

On the other hand, brokerage clients will typically maintain some minimum amount of transactional cash in their account – either out of inertia or maybe just to yolo into GameStop or whatever at a moment’s notice – so cash sorting should diminish as cash balances decline. At year-end, the average Schwab brokerage client had just under ~$15k of sweep cash in their account (down from ~$18k the year before)2 [10]. That’s about 7% of their Schwab assets. Maybe clients now feel compelled to shove a big part of that residual 7% cash allocation into T-bills to juice returns. But then again maybe the average Schwab brokerage client is not as conscientious about optimizing yield as you are.

Several readers replied to my last post with something along the lines of “even if solvency risk is off the table, with rates where they are, cash sorting will be a big headwind to earnings”, as if I disagreed. I don’t. The thesis here turns on the degree and persistence of cash sorting from current levels.

(Update – 3/26: in the original post, I used changes in avg. interest-earning assets as a rough proxy for changes in deposits. This was too noisy to be useful, especially over very short time periods like 2 months, so I deleted it. Doesn’t change the analysis. I was basically trying to get at a reasonable base assumption for changes in bank deposits in 2023 in the lead up to my bear case scenario.)

Again, this doesn’t mean that cash sorting is over (no one’s saying that, not even management), just that the degree of cash sorting diminishes as rate hikes moderate. In its monthly activity statement published March 13, following a week where everyone was freaking out over SVB contagion risk, management backed up this point with some data:

Client bank sweep cash outflows in February were about $5 billion lower than January and March month-to-date daily average outflows are tracking consistent with February. Importantly, these outflows reflect a continuation of client decisions to reallocate a portion of their cash into higher yielding cash alternatives within Schwab. Based on our ongoing analysis of these trends, we still believe client cash realignment decisions will largely abate during 2023.

Over the following days, insiders bought a ton of shares:

I can’t remember the last time I saw so much widespread insider buying in such a short window of time. Given that banking is ultimately a confidence game, it’s possible these purchases were coordinated to signal conviction even as the underlying business deteriorated far more than management anticipated, but that’s a pretty cynical read.

But one need not be cynical to be bearish. In this anxious time, hawkish Fed behavior may carry disproportionate weight given all the attention on bank balance sheets. So let’s go a little nuts with the cash sorting and say that with the Fed rate hiking by 50 bps this year3 [11] deposits fall by 41% from year-end levels, or $150bn. That’s close to twice the net outflows that Schwab experienced last year, when rates moved from 0% to 4%+. Let’s further grant that all deposit outflows are moved into T-bills and nothing is diverted to investment vehicles where Schwab earns management fees.

In this bear case, I also assume the following:

1) the bank balance sheet never grows again

2) cash sorting outflows are funded with $40bn cash, $22bn of short-term govies, $70bn of AFS liquidations, and $18bn of BTFP/FHLB funding

3) client assets continue to grow by ~5%/year. If you’ve followed Schwab for a while you know that this company metronomically grows client assets by 5%-7%. The banking drama unfolding over the last 2 weeks hasn’t changed that. In their March 13 monthly activity statement [12], Schwab reported:

February core net new assets totaled $41.7 billion, our 2nd largest February ever (trailing only February 2021, the height of the meme stock craze). Our growth and momentum have continued into March, with daily net new assets averaging nearly $2B per trading day month-to-date.

They provided yet another update [13] 4 days later:

The Charles Schwab Corporation today announced it has seen strong inflows from clients over the last week. Over the past five trading days (3/10/23-3/16/23), clients have continued to bring assets to Schwab, with approximately $16.5 billion in core net new assets for the week, demonstrating the trust clients place in Schwab.

So let’s say Schwab’s asset management fees, trading and “other” revenue grow in line with client assets, by 5%/year.

4) As a standalone company, TD Ameritrade earned “Bank Deposit Account” fees on the client brokerage cash it swept into TD Bank. Post-acquisition, these BDA balances, which totaled $127bn at year-end, will migrate to Schwab’s balance sheet at a pace of ~$10bn a year until they are reduced to $50bn. On the transferred deposits, the 1% fees it loses on BDA balances is more than made up for by the incremental profits in gains reinvesting those proceeds at higher yields. This was the biggest source of projected revenue synergies at the time of TDA’s acquisition. In this scenario, I assume BDA balances decline along with Schwab’s deposit balances, by 41% this year. And going forward I assume transferred BDA balances, instead of moving to Schwab Bank, are parked in T-Bills.

5) Last year, with the Fed raising from 0% to 4%, Schwab’s deposit rate moved from ~0% to 0.46%. I assume that this year the rate Schwab pays depositors doubles, from 0.46% to 1%.

There are several important earnings offsets to this sorry state of affairs.

First, in response to a 40% decline in net interest income that takes total revenue down 21%, I assume Schwab cuts 5% of its expense base and grows that base by 2/3 the pace of revenue growth thereafter.

Second, I estimate that Schwab still has ~$600mn of cost synergies and (conservatively) ~$600mn of non-BDA revenue synergies remaining from the TDA acquisition.

Third, even after crystallizing losses on $70bn of AFS securities to meet outflows, Schwab is more overcapitalized than it was before, with a Tier 1 Leverage ratio of 8.2%. They could liquidate and realize losses on the remaining $53bn of AFS securities, reinvest the proceeds at significantly higher yields, and still be above their year-end 7.1% ratio (and well above the 5% minimum ratio set by regulators).

Fourth, with the bank balance sheet no longer growing, Schwab doesn’t need to post incremental bank capital.

When I account for these moving parts, it looks like Schwab is doing about $5.7bn of after-tax earnings in year 5 (down considerably from its current ~$8bn run-rate). In the terminal year Schwab is growing revenue by ~2% and earnings by ~3% (more like 4% and ~5%-6%, respectively, if you look past the steady BDA fee decline). At 12x + accumulated earnings + excess bank capital4 [14], Schwab is valued at ~$52/share in year 5, or ~$35 in present value terms, assuming an 8% discount rate (-34% from today’s price of $53). At $53 the stock appears to be pricing in ~$80bn of deposit outflows, followed perpetual bank stagnation5 [15].

Anyway, at a high level what my bear case is saying is that Schwab emerges from this cash sorting cycle a shadow of its former self. Interest earning assets decline by 26% this year and never recover while the spread between what Schwab earns from its investments and pays to its funding sources compresses by 25%, from 2.24% in 4q22 to 1.69%.

I think the chances of this scenario playing out are pretty remote, like less than 10%. Cash sorting will eventually settle down somewhere and the enormous ~$400bn+ of net new assets that flow into Schwab every year like clockwork supplies a natural tailwind to deposit growth. Even if just 5% of net new client assets are swept into bank deposits (compared to 7% of total client assets today), that’s still an additional ~$20bn being put to work every year at juicy incremental spreads. Plus, nearly all of deposits that leave Schwab Bank still remains within the broader Schwab complex and surely some portion of that will find its way to fee-generating investment vehicles.

But my toy bear case scenario, despite its inevitable flaws, is still useful for getting a rough sense of how bad things could get, even if Schwab turns out to be fine from a liquidity/solvency standpoint. When a company might be a good investment but there is a thick fog around earnings power, establishing some semblance of a floor can give you a sense of where it might make sense to add. I have a few points of dry powder with Schwab’s name on it in case the stock trades down to like $40s (though I often change my mind and if the stock trades down to $40 for fundamental reasons that undermine my confidence, all bets are off). But I have no more Schwab appetite beyond that. In truth, as interesting as Schwab looks to me at current prices, I will never size this up to double-digits because…well…see all the caveats in my first post. Most banks are mediocre investments most of the time but if you absolutely must own one, consider John Hempton’s rule [16] about averaging down.

Disclosure: At the time this report was posted, accounts managed by Compound Insight LLC owned shares of SCHW. This may have changed at any time since.

some thoughts on Charles Schwab

Posted By scuttleblurb On In SAMPLE POSTS,[SCHW] Charles Schwab | 9 CommentsI have a post on APi Group and Amphenol coming toward the end of the month but before then I wanted to offer some thoughts on Charles Schwab. Nothing here is investment advice.

Last week I was joking with my friends LibertyRPF [17] and MBI [18] that Twitter felt like a time machine taking me back to 2008-2009, when as a young associate at Fidelity I was tasked with scrutinizing in gruesome detail the balance sheets of insurers and words like “held-to-maturity (HTM)” and “available-for-sale (AFS)” became fixtures in my daily vocabulary. I never expected HTM and AFS to come back into vogue, but here we are. Everyone reading this likely knows by now what these terms mean, but just in case here’s the definition from the SEC [19]:

HTM securities, which management has the intent and ability to hold until maturity, are carried at amortized cost. AFS securities are carried at fair value and unrealized gains and losses are reported as net increases or decreases to accumulated other comprehensive income (“AOCI”).

So what Schwab does is it deposits the cash balances from client accounts into its bank and mostly invests those deposits in US government-backed securities which, while rock-solid from a credit perspective, are still underwater thanks to rising rates. “AOCI”, which you can find in the shareholders’ equity part of Schwab’s balance sheet, primarily reflects after-tax unrealized losses on Schwab’s AFS securities, plus the after-tax unrealized losses on AFS securities that Schwab transferred to the HTM bucket last year to avoid having to include further unrealized losses in AOCI (this will become relevant later).

The “gotcha” hot take goes something like this: did you know that AOCI doesn’t include unrealized losses on HTM securities at year-end and that taking those losses into account would wipe out nearly all of Schwab’s tangible equity? Did you know??….the implication being that Schwab’s bank is technically close to insolvency.

But of course there is a difference, often a huge one, between tangible GAAP equity and regulatorily capital. In banking, there are several capital ratios that need to be maintained above a certain threshold. For Schwab, the most restrictive one is the Tier 1 Leverage Ratio, which divides Tier 1 Capital into assets and certain off-balance sheet exposures. For all but the largest banks6 [20], you can basically think of Tier 1 capital as tangible common equity plus preferred equity minus unrealized gains and losses. What this means is that the unrealized losses on Schwab’s securities don’t impair T1 capital until those losses are realized, either through credit impairment or sale. Because the vast majority of Schwab’s investment portfolio is parked in super safe government-backed securities, its Risk Weighted Assets (the sumproduct of interest-earning assets multiplied by a risk weight proportional to each asset’s credit risk) are very low and its Common Equity Tier 1 Ratio (CET1 – tangible common equity minus unrealized gains/loss divided by risk weighted assets) is a whopping 22%, way above the 7% minimum. So Tier 1 Leverage the far more restrictive ratio and unlike the CET1 ratio, which only counts common equity as capital, any capital holes can be plugged with preferred stock from Uncle Warren.

Since 85% of Schwab’s securities are backed by the US government, we don’t really have to worry about credit quality. But we do need worry about Schwab being forced to liquidate those securities (thus converting unrealized losses to realized losses that hit T1) to meet deposit withdrawals from clients who want to take advantage of higher rates, a dynamic known as “cash sorting”.

At year-end, Schwab reported $40bn of Tier 1 Capital against $567bn of assets, for a Tier 1 Leverage Ratio of 7.2%. The minimum capital requirement is 5% so we’re starting with a $12bn capital buffer that organically expands as the balance sheet shrinks (more on this later).

So a critical question here is: will there be so much cash sorting that Schwab is forced to sell investment securities at a loss, thus dragging the Tier 1 Leverage Ratio below the 7% threshold and forcing a capital raise that potentially death spirals into abysmal dilution. The 22% decline in Schwab’s stock over the last 2 days suggests the market is assigning a non-trivial probability to this scenario.

Here are what I believe to be the sources of funding at the end of 2022, with numbers pulled from Schwab’s 10-K:

Cash: $40bn (excludes $43bn of “Cash and investments segregated and on deposit for regulatory purposes”)

Available FHLB secured credit facilities: $69bn (the Federal Home Loan Banks, FHLB, provides loan advances against a range of collateral to help member banks meet short and long-term liquidity needs. The haircut on government-backed collateral is small [21], 1%-2%, reflecting their liquidity and minimal credit risk. Subsequent to Dec. 31, 2022, Schwab drew down an additional $13bn of FHLB advances. Since we don’t know the intra-quarter sources and uses of funds, let’s ignore this for now. Doing so doesn’t materially impact the analysis)

US Agency and Treasury AFS securities that mature in < 1 year: $22bn (these could be sold without realizing material losses)

Federal Reserve discount window: $8bn

Unsecured commercial paper: $5bn

Uncommitted, unsecured lines of credit: $2bn

AFS securities at fair value minus the short-duration US Agency and Treasury securities listed above: $123bn

(in addition to all this, Schwab has another $173bn of HTM securities, which I treat as untouchable given the impact that realizing losses here would have on statutory capital)

There are a few important caveats.

First, in order to access FHLB funding, banks need to maintain positive tangible capital, the definition of which is set by the Federal Housing Finance Agency who, for reasons that defy logic, includes unrealized losses and gains on AFS securities. So you can see now why Schwab moved $173bn of AFS securities to HTM last year. Had they not done so, any further unrealized losses on those transferred securities would have hit their GAAP tangible equity and possibly compromised their ability to access FHLB funding.

However, even under this more onerous definition of tangible capital, I still think Schwab’s access to FHLB advances is secure. They reported GAAP tangible equity of $16bn at year-end and are generating ~$8bn of run-rate after-tax earnings. Their AFS securities were fair valued at $148bn, which includes $12bn of unrealized losses, $25bn of which rolls off in less than a year. So for Schwab to blow through its $16bn of tangible equity (even setting aside the considerable earnings build and the <1 year maturities) unrealized losses on AFS securities, 85% of which are backed by the US government-backed, would have to more than double from year-end levels. Eye-balling the maturity buckets of Schwab’s AFS securities, this might require a nearly 150-200 bps upward shift across the Treasury curve.

Second, the $69bn of available FHLB advances would be collateralized by a roughly equal portion of Schwab’s $307bn of securities ($148bn AFS + $159bn HTM), but I don’t know much of that collateral would be coming from AFS vs. HTM, so including the entire pool of AFS securities as a source of funds, in addition to $69bn FHLB advance, is double counting to some extent. $69bn of borrowing availability is about 22% of Schwab’s AFS and HTM securities. Multiplying that percentage by $148bn of AFS translates to about $33bn of AFS securities that are pledged as collateral to the FHLB and unavailable for liquidation, leaving us with $90bn of unrestricted AFS.

Third, is there actually $69bn of FHLB funding available? At least one Twitter person [22] thinks no, arguing that “FHLB system isn’t built for these behemoths that are…larger than the FHLB”. While this anon provides no additional context, I don’t think this risk should be outright dismissed. Silicon Valley Bank was unable to tap its full FHLB borrowing capacity for reasons I don’t fully understand. Given the relentless outflows at SVB, maybe the FHLB concluded that lending to them was a lost cause.

To be on the safe side let’s assume that, contrary to Schwab’s disclosures, none of the remaining $69bn of FHLB advances are available and that this year the company is met with a gargantuan $100bn of outflows, nearly 30% of their year-end deposit base. After eating through $40bn of cash and $22bn of short-dated govies, Schwab would need to sell ~$40bn of AFS securities with 1+ year maturities to meet remaining redemptions. The unrealized losses on the full $123bn of >1-year AFS securities was about $12bn at year-end, but let’s say those mark-to-market losses have since widened to like $15bn, or ~$11bn after-tax. In this scenario, Schwab would realize about ~$4bn of a/t losses on its $40bn AFS liquidation. With $100bn of deposits and assets now off the balance sheet, Schwab’s Tier 1 Leverage ratio improves from 7.2% to 8.6%, leaving about $17bn of capital cushion, enough to absorb the ~$4bn of realized losses from the AFS sales, even without taking into account the, say, ~$6bn-ish of pro-forma earnings that would flow into retained earnings throughout the year.

But what amount of outflows can we reasonably expect? Schwab has $17bn of outstanding loan balances that come due after June and, more importantly, X% of $367bn of bank deposits that will cash sort out of the bank and into higher yielding alternatives, either out of fear or greed. What is X?

Well, since cash sorting responds to changes in the Fed Funds rate, it should not come as too big a surprise that Schwab’s bank deposits declined by $77bn ($444bn → $367bn) from 2021 to 2022, as the Fed took rates from 0 to 4%+, the fastest pace of hikes in 40 years.

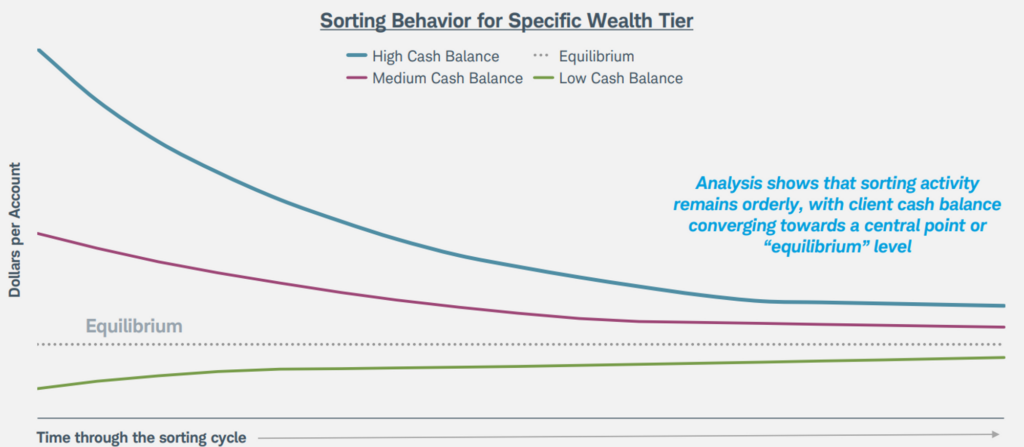

What Schwab has observed throughout its history, though, is that cash sorting settles down as rate hikes cease. Clients want to maintain some minimum amount of transactional cash in their accounts. Whether starting with high levels of cash or low levels of cash, they all converge toward an “equilibrium” level.

According to Schwab, the above analysis was done “across 30 different wealth tiers, across 5 different client segments and the pattern is exactly the same”. On their Jan. 27 earnings call, management claimed they were in the “later innings” of the cash sorting cycle and that the cash they were getting from new accounts was offsetting “any lingering sorting activity” from existing accounts. All this is just to say that if Fed Funds goes from ~4.5% to, let’s say ~5%-5.5% this year, it would be quite surprising to see the same ~$77bn of cash sorting deposit outflows that Schwab experienced in 2022, when rates exploded from 0% to over 4%….and needless to say, the Fed is almost certainly re-evaluating its hawkish posture in light of SVB’s failure and the ensuing anxiety.

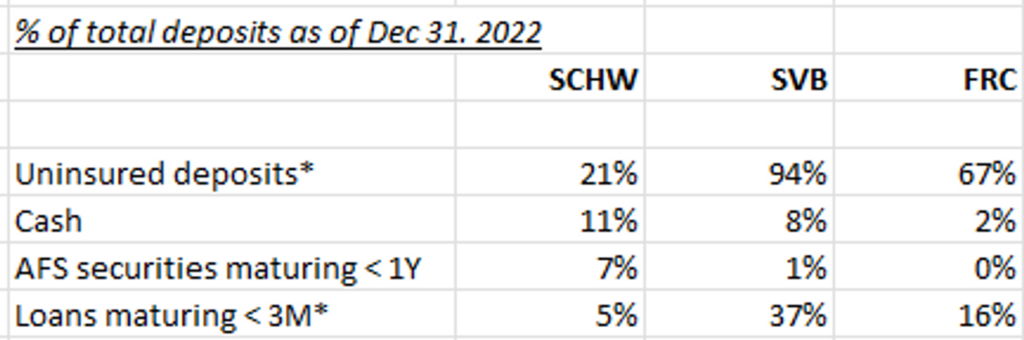

So if this were just about run-of-the-mill cash sorting, I think Schwab could cover deposit outflows under any reasonable bear case scenario. But with Silicon Valley Bank now defunct, things have changed. From a liquidity standpoint, I think Schwab is in a much stronger position than SVB or even First Republic for that matter. Whereas uninsured deposits – that is, deposits exceeding the FDIC insurance threshold and therefore most likely to flee in a panic – comprised an estimated 94%(!) and 67% of SVB and FRC’s total deposits, respectively, at year end, they made up just 21% of Schwab’s. Plus, cash and readily salable AFS securities cover the near entirely of Schwab’s uninsured deposits. The same cannot be said of SVB and FRC.

But anxiety is contagious. You can imagine: someone reads about the SVB collapse, sees that Schwab’s stock is down a lot, assumes something must be seriously wrong there too, and pulls their cash from Schwab bank into T-Bills, forcing more liquidity pressures that push the stock lower, etc. in a reflexive doom loop. In 2022, cash sorting was provoked by rate hikes so rapid that even as bank deposits declined by 17%, net interest income still grew 33%. This year though, if cash sorting is motivated by fear rather than greed, a similar level of outflows would not be accompanied by higher rates. Moreover, FHLB advances are expensive. At year-end, Schwab was paying 4.9% on outstanding balances. If $50bn of ~0% deposits are replaced with 5% FHLB advances (assuming that’s even possible), we’re talking about an incremental ~$2bn hit to after-tax earnings per year on a current run-rate base of $8bn. In short, even if a mass outflow of deposits doesn’t impair capital it may drive earnings lower until people calm down, at which point fear-driven cash sorting is reversed and fresh deposits can be put to work at today’s higher rates. If liquidity concerns prove to be a hiccup and things go back to pre-SVB days in short order, I think there’s a credible path to $6-$7 of per share owners’ earnings (that is, earnings after the incremental capital has been posted to support asset growth) in 5 years. At 20x + accumulated dividends, you’re looking at ~18%-20% returns off the current price ($59).

I admit to being wary about publishing this post, as the reputational damage of being wrong on something like this far exceeds the benefit of being right. If Charles Schwab’s bank teeters into receivership, it will be one of the biggest financial events in years and anyone who suggested that failure was unlikely will be dog-piled with told-ya-so’s. If it turns out that Schwab is fine and the stock recovers to ~$75+, people will shrug and move on with their day.

Let me be clear. While I think it would take a colossal outflow of deposits – something well north of $100bn – to take Schwab down, it would be foolish to deem this scenario impossible given the stench of panic pervading the air. It’s human nature to extrapolate what’s happening today further into the future than is warranted and sometimes this tendency can be profitably faded. But this approach can fail horribly when public confidence itself is an input to intrinsic value, as it is with banks.

A public service announcement is warranted here. My memories of the GFC are all too vivid. I remember bank CDS, quoted in single digit basis points just a year ago, being traded for points up front. I remember puzzling over how to dimension liquidity needs, how big a capital crater subprime CDO exposures might leave, and how much, if any, government support would be available. I remember reasonable-sounding write-ups (like this one!) invalidated within days. I remember an otherwise stolid co-worker pushed to tears by the emotional strain of an especially harrowing week. I wish this on no one. If you think this could be you, maybe just $CSU and chill (not investment advice!).

On Twitter, comparisons between the GFC and what’s happening today have been rightly poo-poohed. Back then, major banks were holding toxic assets on razor thin capital bases. Valid solvency concerns fed into liquidity strains. The term “other-than-temporary-impairments (OTTI)”, where impairment charges are taken on securities whose fair value is not expected to recover to par, was on the tip of everyone’s tongue in 2008. Nobody is using it today because credit quality is not a core issue. But what both periods have in common is fear, and fear doesn’t dispassionately ask whether your securities are par paper, nor does it wait for earnings to leisurely bleed into capital. It punches you in face as it darts for the exit.

(special thanks to @willis_cap [25], who went back and forth with me on Schwab throughout the weekend while he was on vacation in Hawaii and offered helpful suggestions to this write-up)

Disclosure: At the time this report was posted, accounts managed by Compound Insight LLC owned shares of SCHW. This may have changed at any time since.

Discount Brokers: Disruption, Bundling, and the Battle for the Mass Affluent; Part 2

Posted By scuttleblurb On In [ETFC] E-Trade,[IBKR] Interactive Brokers,[SCHW] Charles Schwab | Comments DisabledRelated Post: Discount Brokers: Disruption, Bundling, and the Battle for the Mass Affluent; Part 1 Interactive Brokers Sustainably profiting from a commodity service like trade execution requires, at the very least, a low cost advantage, which in the brokerage space belongs to Interactive Brokers. Despite realizing ~half the commission dollars per trade, Interactive generates the highest […]

Discount Brokers: Disruption, Bundling, and the Battle for the Mass Affluent; Part 1

Posted By scuttleblurb On In [AMTD] TD Ameritrade,[ETFC] E-Trade,[IBKR] Interactive Brokers,[SCHW] Charles Schwab | Comments DisabledI define culture as the set of unspoken assumptions that guides behavior. Whether it intends to or not, every company has a culture. However, not every culture, even ones underpinned by values that make the world a better place, confers competitive advantage. From the perspective of value creation, the question is not so much is […]