Trivago’s “relevance assessment dimension”, implemented in late 2016, is an algorithmic adjustment that compels hotel advertisers to improve their landing sites and booking engines if they want to rank higher in trivago’s search results. The idea is that while the user experience starts with a room search on trivago, it extends to when she clicks off to actually book the room on the advertiser’s site…so if the advertiser screws up that last step (according to trivago), it will have to pay more for each referral. One consequence of this change was that trivago penalized OTAs whose links sent users to yet another page of search results on OTA.com rather than directly to the property that the OTA listed on trivago.

While trivago technically has 200+ advertisers competing for placement in its marketplace, two of them, Expedia and Priceline, respectively comprise 36% and 43% of the company’s revenue. [Expedia acquired 63% of trivago from early investors in 2013 and continues to own 60% of the company post its December 2016 IPO]. It’s usually not a good idea to behave like a powerful aggregator towards two dominant customers who actually are powerful aggregators when you, actually, are not…but that’s essentially what trivago did, tasking its algorithm to extract the most value from advertisers in zero-sum fashion while providing CRM, bidding, and booking tools for smaller hotels – including “express booking” where trivago actually hosts the booking site on behalf of the advertiser – to compete more effectively against the OTA giants with the aim of stoking greater bid density and pushing the agencies, in trivago’s own words, towards “the pain points of their profitability targets.”

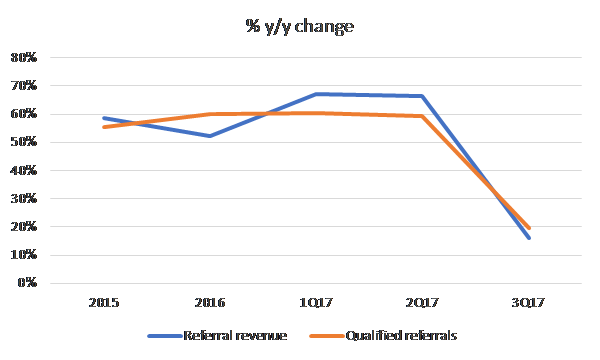

In the first several quarters after implementing relevance assessment, trivago saw qualified referrals ~+60% y/y and revenue per qualified referral (RPQR) growth of +4%-4.5%. The company admonished that RPQR would be lower (or, euphemistically, “normalized”) in the second half of 2017 since as advertisers adapted their sites to trivago’s relevance assessment standards, they would be not be required to bid as much for traffic. No big deal. But then things took a turn for the worse. On 9/6/17, trivago announced that revenue growth for the full year would be more like 40% instead of 50% and EBITDA would be lower than guided too, as the RPQR hit turned out to be worse than expected.

The charitable interpretation to this bleak outcome, the line that management continuously parrots to investors, is that by optimizing the user experience, trivago is nobly sacrificing near-term profits for the sake of long-term gain. Management understands that having loyal users is the key to spinning up a platform that gives you license to marginalize suppliers (advertisers, in this case), and so trivago is splurging on TV advertising [over 90% of the company’s revenue is dedicated to sales and marketing], assiduously monitoring the results, and iteratively tweaking campaigns towards the aim of building brand value. At the same time, by adjusting its bidding algorithm and forcing suppliers to play ball, it is ensuring that users have the most seamless search and booking experiences possible.

But it’s not clear to me why Trivago feels uniquely positioned to accomplish the task of creating memorable ads or whatever it is that they think drives persistent site visits. Because unlike, say, a SaaS model, where the journey from site visits to free trials to paid subscriptions sucks the user into ever deeper states of captivity that can, in theory, generate sticky, layered recurring revenue streams, what is the lock-in mechanism here? At least TripAdvisor can claim authentic and current user-generated reviews. Google began with a superior mousetrap and didn’t need to spend gobs on advertising to attract users (plus, because general search is so frequently used, it is habit-forming in a way that travel-specific search is not). Trivago’s vertical search has, well…what exactly…to keep users continuously coming back once they have clicked off the site? And furthermore, what can’t be replicated? Expedia offers its own version of relevance assessment, its Accelerator program encouraging hotel properties to graduate up the Expedia listings page by paying extra commissions or by improving quality scores.

Growth in qualified referrals and referral revenue have decelerated in dramatic fashion. No bueno:

[Definition of qualified referrals from the F-1: “We define a qualified referral as a unique visitor per day that generates at least one referral. For example, if a single visitor clicks on multiple hotel offers in our search results in a given day, they count as multiple referrals, but as only one qualified referral. While we charge advertisers for every referral, we believe that the qualified referral metric is a helpful proxy for the number of unique visitors to our site with booking intent, which is the type of visitor our advertisers are interested in and which we believe supports bidding levels in our marketplace.”]

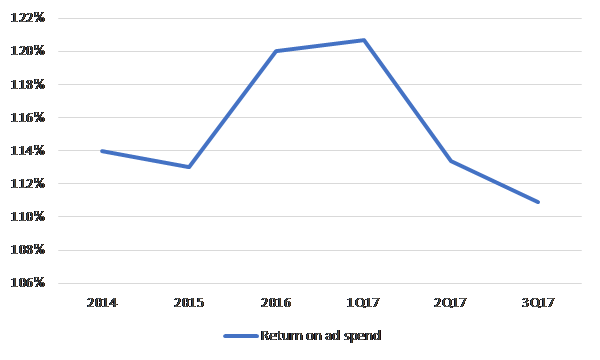

And with that, the potency of trivago’s brand advertising also appears to have waned, as the company experienced significant y/y de-leverage on sales and marketing in the latest quarter and declining returns on ad spend over the last 2 quarters:

ROAS weakness also happens to coincide with TripAdvisor’s renewed commitment to brand advertising this year, so on top of volume weakness, perhaps TRVG is also witnessing pricing pressure on ad units? [After spending $51mn on TV advertising in 2015, TripAdvisor reallocated marketing dollars to online search and spent nothing at all on TV in 2016. They’re committing $70mn-$80mn this year as part of a multi-year brand ad campaign].

If online travel were fragmented up and down the value chain, then being the first to spend aggressively on brand advertising for the sake of creating a liquid marketplace that then itself becomes the value proposition, might just work. The numbers are tempting. Global online hotel bookings of ~$145bn comprise around 1/3 of the total offline + online hotel bookings and are taking share from the offline channel. At a 15% take rate, that’s a $22bn addressable market growing low double-digits annually. On its current revenue base of $1bn, claiming even a small share of that could drastically move the dial. But the question of course is, can you grab share at compelling economics? I don’t understand the fundamental value proposition offered by trivago that cannot be offered equally well by many other top-of-funnel peers or even further down-funnel for that matter.

This is why I find I Trivago’s competitive positioning so precarious: it doesn’t possess the bargaining power to procure traffic at advantaged cost nor an irreplicable process to transform that traffic into value so compelling and unique that even their powerful customers will cede economic ground. Online travel is increasingly dominated by aggregators further downstream who have myriad acquisition channels – including Facebook, Google, and direct brand advertising – through which to lure travelers. And as in any highly competitive market, attempting to generate sustainable value off brand advertising is an unwinnable game unless there is a differentiating resource at the core.

At the Citi Tech Conference last month, when asked about competitors recently copying trivago’s strategy, the company could offer only the following effete non-statement:

“I think the only sustainable competitive advantage that you can have is to continue to be ahead of your competition. And so, the competitive response is to continue to innovate in marketing and in product and make sure that there is always a gap between yourself and competitors that are copying what has worked very well for you. I think that sounds generic, but I think that’s the only thing you can do.”

TRVG’s management maintains that its can sustain 25% EBITDA margins at some point (better than Expedia’s high-teens EBITDA margins). I doubt it.

TripAdvisor is the Twitter of online travel: a unique, hard-to-replicate asset that eludes monetization but has significant strategic value. There’s clearly a double marginalization problem to be solved via vertical acquisition, which TRIP Chairman Greg Maffei seems open to. And that might really be the primary reason to hold on to the stock. Well, that, plus the non-hotel side of the business (attractions + restaurants) is killing it, growing revenue by 25%-30% over the last year and solidly profitability. That business is probably worth ~$1.5bn (4.5x revenue), leaving $2.4bn in enterprise value for a hotel business, one facing revenue and cost pressures, doing around $200mn in EBITDA (after stock comp). By comparison, trivago’s enterprise value is $1.8bn, and they’re doing only $13mn in EBITDA. The value disparity makes little sense.

[Re: “hard-to-replicate”, as I previous wrote:

“Over 360mn people visit the company’s site every month to plan their trips because they trust its deep fount of nearly 500mn authentic and current user-generated reviews and 90mn photos on 7mn hotels, attractions, and restaurants. Those travelers, upon completing their trips, post their own reviews, contributing to a burgeoning body of shared knowledge that drives traffic through better search engine rankings and compels still more potential travelers to visit Tripadvisor at the start of their research process. The company further stokes participation by offering badges and other marks of distinction to particularly helpful and active reviewers. Hoteliers, well aware of Tripadvisor’s critical top-of-funnel role, make a special effort to respond to consumer reviews. If you’ve stayed at a hotel boutique, you will have no doubt been encouraged at some point to leave a review on Tripadvisor by the hotel manager, who often proudly plasters the property’s Tripadvisor rating on the front window as a point of differentiation. It would be monstrously difficult to recreate the breadth and depth of TRIP’s reviews.”]

[“Monstrously difficult”? A bit hyperbolic on my part. In theory, I guess I don’t really see why the Priceline, which already has over 135mn hotel reviews, couldn’t expand its share as it garners more direct traffic through brand advertising]

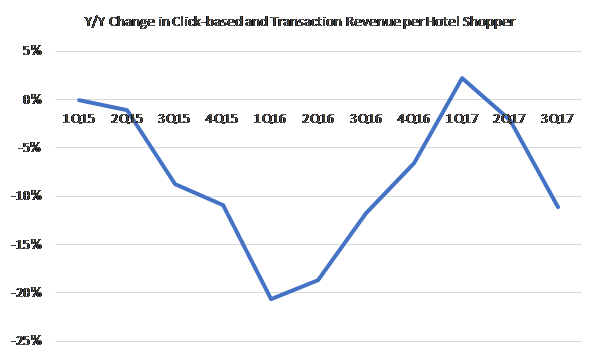

In prior quarters, the y/y decline in TRIP’s revenue per hotel shopper was largely attributed to a mix shift from desktop to mobile, a concern alleviated by the hope that mobile monetization improvement would eventually overcome such dilution. But now, bid-downs by Priceline, which is shifting ad dollars to brand advertising after years of diminishing ROI on performance marketing, have whacked monetization on the desktop side and confounded several quarters of positively inflecting trends.

After a two-year hiatus, TripAdvisor also recently began splurging on TV advertising…so, on top of getting hosed by its largest customer on the revenue side, TripAdvisor is now competing with Priceline for TV ad spots as both pursue a common goal of driving more direct traffic to their own sites. It’s hard not to be cynical about TripAdvisor’s standalone role in the value chain.

So, with trivago implicitly raising bid prices and both trivago and TripAdvisor trying (and, in the latter case, failing) to encroach directly upon bookings, it appears that Priceline is finally saying “nuh-uh” and using bid downs as part of a bargaining tactic to keep suppliers in check. Whether the shift from performance to branded advertising is structural seems inconclusive. Recent comments from Priceline CEO Glenn Fogel:

“I think one of the things very important to recognize is the dynamic nature of how the performance marketing works. So while we can make change in terms of how much money we want to spend and we where we want to spend it, our partners are also making changes all the time, and other people and auctions are making changes. So, this is dynamic and interactive, so it’s difficult to project long term what’s going to happen.”

Still, Priceline has been talking about pressure on performance ad returns for some time and even as Expedia professes loyalty towards trivago as an acquisition channel, it admits that meta search generates lower “repeat propensity” than search engine marketing. In any case, what seems abundantly clear is that TripAdvisor and trivago, who derive 46% and 79% of revenue, respectively, from Priceline and Expedia, are really in no place to dictate terms. Generating extra-normal profits as standalone entities, like the kind implied by the obligatory “small x% of big $TAM” exhibit that these guys all like to use, requires TRIP and TRVG either claiming a fair share of extraordinary surplus or an unfair share of modest surplus. The absence of a uniquely compelling value proposition impedes the former; industry structure constrains the latter.

Implicit in my TRVG/TRIP bashing, however, is that value in the this industry accrues a level below and in that spirit, Expedia could be interesting. EXPE sold off last week as the company noted that its cost structure would be larded with investments related to accelerated hotel on-boarding [3 years ago, EXPE was adding 25k-30k hotels / year, this year it’ll be 80k, and will “step change” in future years], cloud computing [a 2-3 year transition. $100mn this year, much greater than management’s guidance a year ago, growing by over 50% next year], and marketing [as management turns its attention to deepening local marketplace liquidity after years of broad-based acquisition].

Expedia isn’t the cleanest company with the strongest moat – the core OTA is dependent on Google for traffic and faces competition from a consolidating supplier base, HomeAway is up against AirBnB, tech stack integration across a slew of acquisitions appears to have been sloppy – but as the second largest OTA by bookable properties next to Priceline, the company has certainly crossed the threshold of critical scale and fostered a sustainably profitable two-sided marketplace. Disintermediation concerns stemming from an increasingly consolidated supplier base and worries about Google/Facebook aggressively moving into the space, have plagued OTAs for years…but Priceline and Expedia have done just fine as continuous investment in technology, marketing, hotel relationships, and vigorous A/B testing have congealed into a hard-to-replicate value proposition for suppliers looking to offload inherently perishable inventory and travel shoppers looking to dependably source the broadest, most relevant selection at the lowest price, with increasing participation on each side of the platform begetting buy-in from the other.

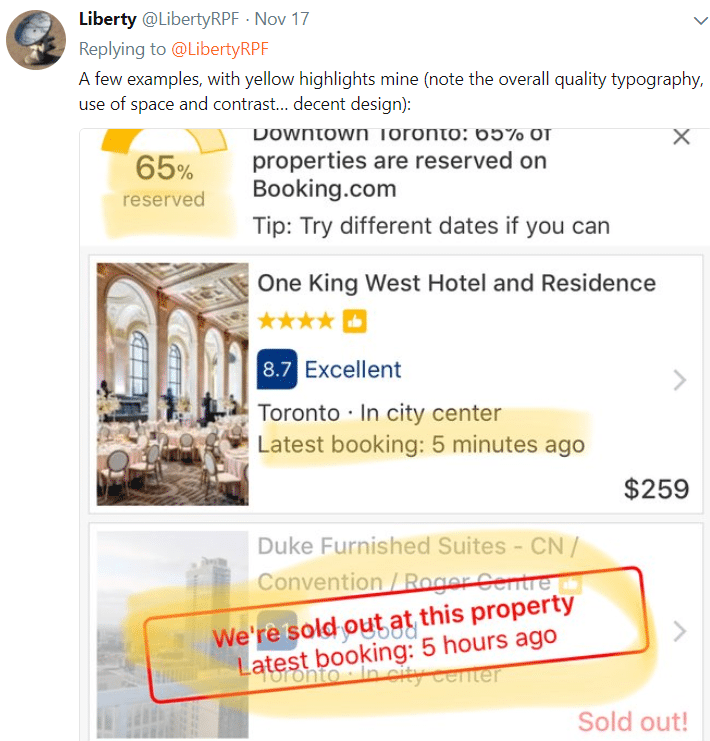

[Re: A/B testing, as one Twitter friend put it…

HomeAway, acquired for what seemed like a pricey $3.9bn in December 2015, has been growing rapidly (+40%-50% y/y) and profitably in the face of competition from AirBnB and Priceline, and now seems like a pretty smart buy. And Expedia is still in the process of making all ~100k vacation rentals available exclusively online (some bookings are currently arranged offline between guest and host) [1], and has not yet really begun to pursue international markets or fuse Homeaway listings with inventory from its core OTA sites in cities.

When I strip out trivago and stock comp (see below), it looks like Expedia is trading for around 11x EBITDA and 17x FCFE, which seems reasonable to me even if we grant that EBITDA growth will slow to the bottom end of the +10%-20% range (or even somewhat below) for the next few years on accelerated spending…and it looks quite cheap if we think that by weaning itself off acquisitions, dedicating itself to organically deepening engagement, broadening the platform through aggressive on-boarding, and boosting overall productivity by partly shifting its tech infrastructure to the cloud, Expedia can drive accelerated bookings growth and margin expansion 3 years out. At the very least, I think we can be far more confident that Expedia’s investments offer a reasonable return than that trivago’s continuous spending on TV commercials will ignite sustainable platform activity.

($ millions except per share data)

| EXPE TEV ex. TRVG cash | 19,159 |

| TRVG stock price | $ 7.17 |

| x # TRVG shares owned by EXPE | 209 |

| = | 1,499 |

| Adj. EXPE TEV | 17,661 |

| EBITDA ex. TRVG | 1,589 |

| multiple | 11.1x |

| FCFE ex. TRVG | 1,249 |

| Stock comp ex. TRVG | 135 |

| EXPE FCFE ex. TRVG ex. stock comp | 1,114 |

| /share | $ 7.06 |

| multiple | 17.4x |

You can also own Expedia through Liberty Expedia (LEXEA), which owns 15.5% of Expedia’s common stock representing a 51.9% voting interest in Expedia…but, I don’t think there’s a compelling “arb” here. LEXEA split off from Liberty Ventures a year ago for the purpose of Expedia eventually purchasing LEXEA’s EXPE shares. Liberty Expedia also owns an internet retailer of health and dietary supplements called Vitalize (formerly known as Bodybuilding.com), which, based on declining revenue and profits, isn’t doing so hot, and has deteriorated to such an extent that it is small enough to be unceremoniously lumped into “corporate and other”. It does around $316mn in trailing revenue with negligible OIBDA.

You are getting 0.41 shares of EXPE for every 1 share of LEXEA that you own. LEXEA also has around $5.40 in net debt / share. So the NAV breaks down like this…

| NAV | |

| Expedia | $ 50.43 |

| Net debt | $ (5.36) |

| Vitalize | ??? |

| Total | $ 45.07 |

…vs. LEXEA’s current share price of $46. The delta between NAV and the LEXEA share price values Vitalize at around 0.2x trailing revenue. Seems fair. Whatever.

Priceline’s stock also sold off post-earnings on decelerating bookings (from ~mid-20s y/y ex. fx growth over the last 4 quarters to 16% in the latest quarter). While size constraints may translate into slower growth relative to the past, there’s plenty of runway ahead. Its largest online property, Booking.com, has an insurmountable moat in a fragmented European market [in Europe, independent lodging comprises 67% of total rooms vs. 30% in the US] where I estimate it claims around 40% of European online accommodation bookings, or about 20% of total European bookings. Globally, Priceline’s ~$80bn of total gross bookings is just 20% of online hotel bookings, or about 6%-7% of total online + offline. Room nights +19%, the number of bookable properties +41% (including vacation rentals +58%) during the most recent quarter, and the meta properties, Kayak and (more recently) Momondo, are growing and profitable. OpenTable, on which the company took a huge impairment charge last year, has sucked, but I think we’re past that. I don’t see any meaningful impediments to Priceline continuing to grow its cash earnings per share by mid-teens+ for the foreseeable future.

So yea, setting aside the takeout aspect for TripAdvisor and just evaluating these companies on their standalone long-term value creation potential, I would rather own Priceline (17x EBITDA backing out long-term investments, including Ctrip) or Expedia (11x), respectively, than either Trivago (NM) or TripAdvisor (17x).