MBI and I recorded an episode of Never Sell recently (Big Tech Earnings) (Spotify, Apple, YouTube, RSS feed) Having just written up Watsco, I thought I’d offer some thoughts on revisit Pool Corp. given the similarities between the two businesses. Pool Corp is a distributor of pool supplies and equipment. It sources ~200k SKUs from 2k+ suppliers and sells them to […]

How Pool stacks up to Watsco

Posted By scuttleblurb On In [POOL] Pool Corp. | Comments DisabledRemitly looks interesting

Posted By scuttleblurb On In [RELY] Remitly | Comments DisabledIt may not be entirely fair to think of Wise as “cross-border transfers for yuppies”, but that’s just where my mind goes. After all, the company grew out of a scheme devised by two white collar professionals – Taavet Hinrikus, a Skype employee in Estonia, and Kristo Kaarmann, a Deloitte consultant in the UK. Taavet […]

[KNSL] Kinsale is built for speed

Posted By scuttleblurb On In [KNSL] Kinsale | Comments DisabledOne way to carve up the investment universe is between standardized products, like index funds, that run on fixed rules and scale effortlessly, and bespoke ones, like distressed credit or esoteric ABS, where the risk is niche and full of weird wrinkles. In the world of property & casualty insurance, “admitted” lines are more like […]

thoughts on Watsco

Posted By scuttleblurb On In [WSO] Watsco | Comments DisabledWhile investors continue to be enthralled by AI and all things Tech, I can’t help but think there are easier opportunities being overlooked in boring industries that don’t make the business news or saturate our Twitter feeds. So you’ll have noticed that in recent months, I’ve been looking beyond the white hot center, concentrating my […]

scuttleblurb business update (2025)

Posted By scuttleblurb On In SAMPLE POSTS | No CommentsI’m sure you’re sick of these annual newsletter recaps by now, so I’ll keep mine brief.

In a recent Acquired interview [4], Michael Lewis articulated what I’ve long appreciated about working for yourself in a creative field – that you don’t need to constantly optimize for the very last dollar. The marketplace may be rewarding certain kinds of behavior and content. You can choose to ignore that signal. I’ve often spent weeks researching a name just to scratch a personal itch, knowing in advance that no one would read the resulting write-up (I’m looking at you, Booz Allen!).

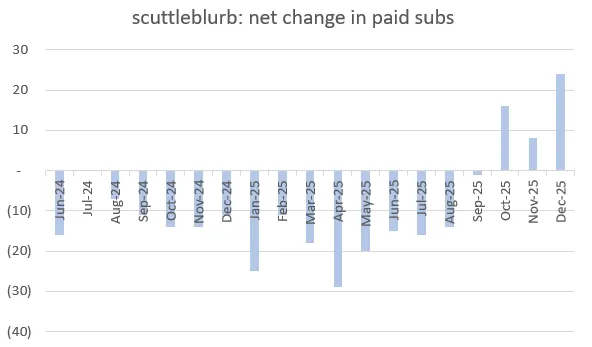

At the same time, if you intend to earn a living from newsletter writing, you can’t do that by sequestering yourself from readers and ignoring feedback entirely. The line need not always go up, but it can’t keep going down either. And for years, my line kept going down. From its September ‘21 peak to its September ‘25 trough, my paid subscriber count declined by 25%.

It goes without saying that lucid writing and insightful takes are critical to attracting and retaining subs. But I’ve also come to believe that three other things matter a great deal:

Frequency: last year, I noticed several peers announce a more frequent publishing cadence. This is not only a good move, it is a business necessity. Whoever said “quality over quantity” hasn’t tried writing a paid newsletter. Quantity matters a lot. It establishes habit and embeds the author as a background presence in readers’ minds. New posts also lure free subscribers to the paid tier. The more you post, the more conversion opportunities you get.

Thematic consistency: investment interests tend to cluster by industry or style. Those who are into “quality compounders” generally eschew mangled turnarounds. Those who gravitate toward consumer stocks are also often drawn to media and consumer-facing tech, but don’t generally give a hoot about heavy industrials. And so, a newsletter that ricochets from tech to housing to commodities to serial acquirers to turnarounds will struggle to deliver consistent value to readers, any one of whom is going to be narrowly focused on just a few of those categories. Said differently, by limiting coverage to industries or styles that tend to cluster together, you are far more likely to write posts that are reliably relevant to any given reader.

Also, there is a trade-off between publishing cadence and breadth of coverage. Because it is impossible to stay constantly fresh on like ten unrelated sectors at once, the more frequently you publish, the more you will find yourself specializing in a particular domain. It works the other way too. Writing consistently about a few related sectors makes it easier to respond to news flow quickly and with the proper context since you are building incrementally on knowledge from the day before, and the day before that, etc.

The current thing: people pay for business-oriented newsletters, in large part because they are looking for lucrative ideas. But let’s not overlook social incentives. People want to feel informed about the stuff everyone is talking about. To impress their peers. To fit in. To stand out.

You can trade off any one of these so long as you over-deliver on the others. Publishing monthly can work if every post is a deep dive banger on AI, robotics, or some other current thing. The current thing can be sacrificed if you publish thematically consistent posts at high velocity. But for maximum effect, it helps to excel at all three.

In the world of business analysis newsletters, no one covers all bases as comprehensively as Ben Thompson of Stratechery [5]. Ben writes several posts a week. He brings insight and context – informed by more than a decade of industry-specific coverage – to the most prominent tech stories of the day. Similarly, my friend and podcast partner, MBI [6], has been crushing it [7] since moving to a daily publishing regiment and focusing on tech.

Tech is particularly conducive to the paid newsletter model. It is, of course, THE current thing. It is also a dynamic field that spews torrents of news flow and takes…and takes on takes…so there is never a shortage of topical discussion points in any given week. Moreover, competitive boundaries are especially blurry across subdomains (and becoming more so with AI), which translates to significant interest overlap across them. If a reader cares about Google, they will also likely be interested in AirBnB, Uber, Salesforce, and Nvidia. But you can drill down to almost any niche within tech and discover a continuous stream of pressing issues that tons of people care about, as Semianalysis [8] has demonstrated with semiconductors and Mobile Dev Memo [9] has with digital advertising. Finance is another domain characterized by high velocity newsflow, high interest overlap across topics, and front page news. Matt Levine [10] and Marc Rubenstein [11] both do excellent work here.

Anyways, a huge business challenge I faced as a generalist publishing infrequent deep dives was that every post I published would be relevant to a different subset of subscribers. Among those who read my writeup on Align, how many also read my writeups on SECURE Waste, Charles River, and payroll processing SaaS? Not many I’d bet. There just isn’t much interest overlap across those names. $320 a year was a bargain if you read all fifteen or so deep dives I’d publish in a given year (imho!). Much less so if you only read one or two. I suspect that many readers paid for my blog on an ad hoc basis, much as they would a book. They’d subscribe monthly to read one post, immediately churn, then pay the monthly rate again when I wrote something else that interested them (and immediately churn, again).

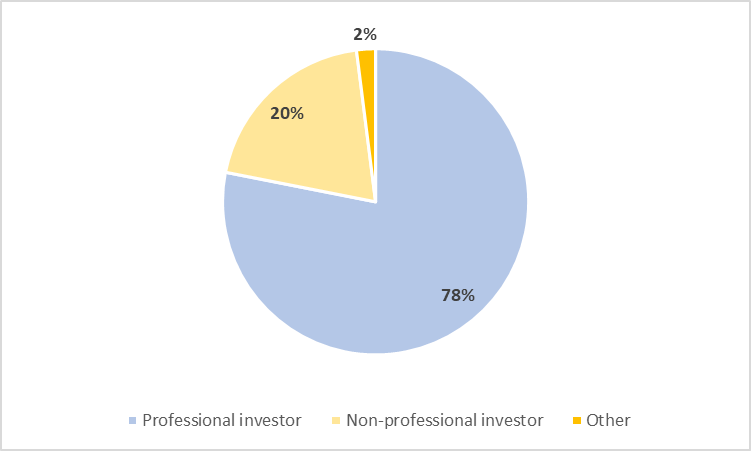

There are ways around this. I could let Twitter buzz guide where I spend my time. But pretty much the whole reason I quit my hedge fund job was to not have my research agenda dictated to me by others. I could raise prices every year. Nearly 80% of my paid subscribers identify as professional investors, which makes me think there is a committed core who’d be willing to pay much more than $320/year. But I don’t like the idea of jacking up prices year after year to compensate for an ever shrinking subscriber base, even if the net result is more revenue. I will if I have to, but I’d much rather grow through subscriber count (so tell your friends to subscribe! ;)). I could narrow my coverage to a few specific, high interest sectors. But my research interests span many different sectors and, again, I gotta do me.

So if “thematic consistency” is out of the question, that leaves “frequency” and “the current thing”. Now these, I can do. Last September, I formalized my move into higher frequency publishing with the launch of scuttlebits [12]. What I’ve found so far in writing these is that I can’t help myself and often what was intended to be a short 500 to 1k word post grows to 3k to 4k words. Whatever. Doesn’t matter. Whether a post carries the label “scuttlebit” or not is somewhat arbitrary. The point is that you should expect something worth reading to hit your inbox every 7 to 10 days.

I’m also making more of an effort to publish topical posts. I’ve literally written about hundreds of companies across a wide range of industries over the last 8 years. This cuts against thematic consistency but also comes with the benefit that, at any given time, there is bound to be something interesting happening to a company or industry I’ve written about in the past. I should obviously take advantage of that. And even as I continue to base my research choices strictly on what appeals to me, I could also be more attuned to times when my interests just happen to intersect with those of my audience and prioritize names that I planned to get to anyways but that have some Twitter buzz around them today.

This is all pretty obvious stuff, to be sure, but just not something I paid any attention to in the past. I researched and published with no regard for what my subscribers wanted to read. I’ve always treated scuttleblurb as a lifestyle business….and I still do. I am not after growth for its own sake. So long as revenue keeps pace with inflation from here, I’m good. But it’s clear that achieving even this modest goal requires that I be a bit more commercially minded than I have been.

The good news is that the adjustments I’ve made so far appear to have had a dramatic impact. Almost as soon as I started publishing at higher frequency, my net paid adds flipped positive, reversing 16 consecutive months of zero/negative growth. For the full year, my paid subscriber count shrank by 8%, but revenue (after expensing Substack fees) was up 18% to an all-time high, thanks mostly to a significant across-the-board price hike I imposed in November 2024. The Substack version of scuttleblurb grew gross ARR by 51%, with nearly 2/3 of that growth concentrated in the the four post-scuttlebit months of the year (I don’t have an easy way of calculating change in ARR for the WordPress version of the site).

I’ve been doing this long enough to know that one should not too eagerly attribute strong results to specific actions. Subscribers come and go for mysterious reasons. The recent boom could be a fluke. I’ll have a much better sense as this year unfolds.

Thanks again to everyone who’s subscribed. It means the world to me that with all the excellent blogs out there, you choose to devote some of your scarce attention to mine.

Wishing you a prosperous new year,

David

[ODFL, SAIA, XPO] the LTL carriers are going to be ok

Posted By scuttleblurb On In [ODFL] Old Dominion,[SAIA] Saia,[XPO] XPO | Comments DisabledIf I were to tell you about a company whose main job is to move freight from one place to another and whose primary assets consist of trucks and trailers, you’d probably think I was describing a capital intensive business with low entry barriers subject to brutal, commodified competition. And I could be! There is […]

[AVTR] a poor man’s Thermo Fisher

Posted By scuttleblurb On In [AVTR] Avantor | Comments DisabledAvantor is like Thermo Fisher in some respects. It distributes lab products and sells bioprocessing tools. It, too, was built through transformative M&A. It even has an analog to PPI – the kaizen-based continuous improvement framework Thermo Fisher adopted from Danaher – in the form of the Avantor Business System. But sadly, these surface similarities […]

Survey results + programming notes

Posted By scuttleblurb On In Uncategorized | No CommentsHi everyone – on Monday, I’ll share some thoughts on Avantor in my final post of the year. Immense gratitude for all your support. As rewarding as 2025 was from both a business and content perspective, I think 2026 is going to be even better. The research pipeline is in great shape. Writeups on LTL carriers (ODFL, XPO, SAIA), Watsco, Pool, Thermo Fisher, and Danaher are all in progress and will be published in the first few months of the new year.

Here are the results from a survey I recently sent to paid subscribers:

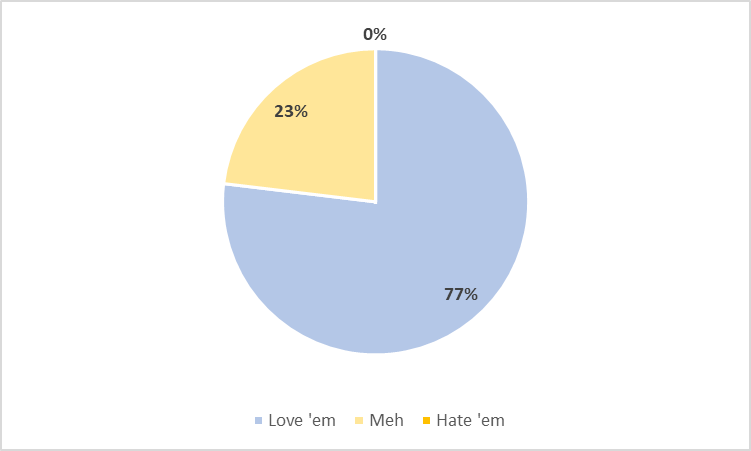

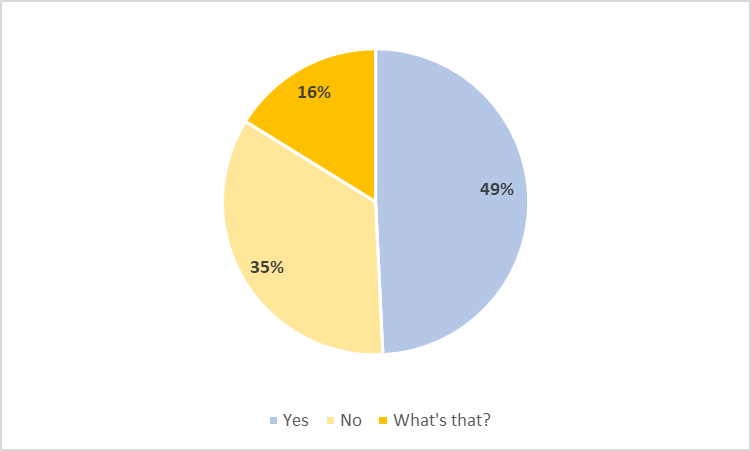

I recently launched scuttlebits: short-form commentary, mostly related to notable developments on companies I’ve already covered, published every 7 to 10 days or so. What do you think?

(134 responses)

How would you describe yourself?

(136 responses)

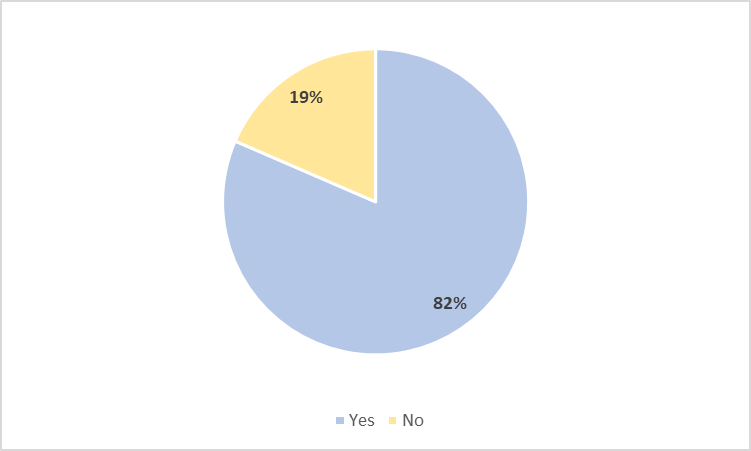

Have you listened to more than a few episodes of the Never Sell podcast?

(136 responses)

For those who selected “what’s that?”, Never Sell is a monthly podcast where MBI [13] and I discuss various investing-related topics (Spotify [14], Apple [15], YouTube [16])

Do you regularly use AI tools in your research process?

(135 responses)

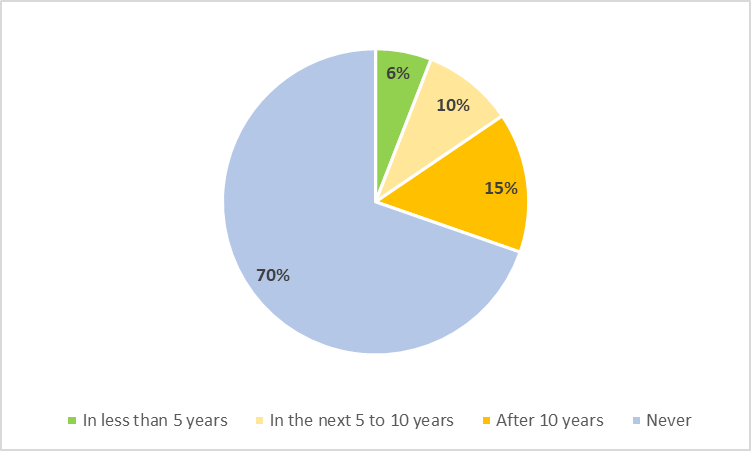

When will AI put me out of a newsletter writing job?

(135 responses)

Thank you to the more than 100 of you who sent in stock pitches! Lots of interesting ideas in the mix, many of which I’ve added to my research pipeline.

Finally, on a personal note, I’d like to draw your attention to a GoFundMe [17] that I set up last year for Boulder Crest Retreat [17], a non-profit that helps veterans, servicemembers, and first responders heal from trauma. As many of you know, my brother was a combat vet who served in Iraq and Afghanistan, and took his own life in 2024 after battling PTSD. Thank you to everyone who has donated. If you haven’t yet, I hope you consider doing so!

It is a joy and privilege to write for you all. Have a safe and happy holiday season, David